,1,2,3, 杜德斌

,1,2,3, 杜德斌 ,1,2,3, 刘承良1,2,3

,1,2,3, 刘承良1,2,3The evolution process and growth mechanism of global cross-border M&A network

HUANG Xiaodong ,1,2,3, DU Debin

,1,2,3, DU Debin ,1,2,3, LIU Chengliang1,2,3

,1,2,3, LIU Chengliang1,2,3通讯作者:

收稿日期:2020-07-15修回日期:2021-05-5

| 基金资助: |

Received:2020-07-15Revised:2021-05-5

| Fund supported: |

作者简介 About authors

黄晓东(1993-), 男, 河南安阳人, 博士生, 研究方向为区域发展与全球创新。E-mail:

摘要

关键词:

Abstract

Keywords:

PDF (3594KB)元数据多维度评价相关文章导出EndNote|Ris|Bibtex收藏本文

本文引用格式

黄晓东, 杜德斌, 刘承良. 全球跨境并购网络的空间格局演化及形成机制. 地理学报, 2021, 76(10): 2536-2550 doi:10.11821/dlxb202110014

HUANG Xiaodong, DU Debin, LIU Chengliang.

1 引言

准确把握经济全球化运行规律,深入分析世界地理经济格局演化动向,是中国积极应对世界百年未有之大变局的重要基础。20世纪90年代以来,跨境并购作为跨国公司实施全球化战略的重要手段在全球大规模兴起[1],成为驱动世界百年未有之大变局的重要变量之一。据联合国数据库全球投资数据显示,2000—2018年全球跨境并购年均交易额占全球对外直接投资年均总额的比重达到39.59%。国际间大规模的跨境并购活动既深刻影响了经济全球化和全球资本流动,也为世界经济地理格局的深刻重塑提供了驱动力[2,3]。就中国而言,跨境并购业已成为当下中国企业“走出去”参与全球竞争的重要途径。相比于世界经济的持续低迷,2008年以来中国企业的跨境并购活动整体“逆势增长”,2009—2016年其年均交易量增速达到10%,年均交易额增速更是高达27.9%[4]。崛起的中国企业也正在通过跨越国家边界的并购投资行为,提升自身国际竞争力的同时助推经济全球化进入新时代。因此,探讨全球跨境并购的时空规律、定位中国在全球跨境并购体系中的位置,是理解百年变局下世界经济地理格局演化规律的关键抓手。跨境并购长期以来是经济学、管理学、会计学等学科领域的核心研究话题,但同样具有显著的地理学研究内涵[2, 5]。经济学、管理学、会计学等的研究主要聚焦于微观的企业层面[2, 6-7],关注企业开展跨境并购的动因[8,9]、跨境并购后的企业整合[10,11]以及跨境并购对企业的财务、会计、运营等绩效影响等内容[7, 12-14]。其中,虽有大量文献提及区域间差异(如文化、制度、语言等)、空间距离等地理要素是国家间跨境并购产生的重要影响因素[15,16,17],但由于缺乏地理学空间思维,常将“地理影响”作为隐喻,忽视对跨境并购的空间规律、空间效应和空间后果等的专门论述与探讨[2, 6]。事实上,跨境并购不仅只是企业所有权的变更过程,也是企业在全球尺度的扩张与组织过程[18],更是本地企业在异地网络的“嵌入(Inserting)”过程,会对区域经济地理格局产生深刻影响[19]。早在20世纪80年代末,国际著名地理学家Clark就注意到这种地理现象,指出“套利经济(即跨境并购)”正在重塑企业资本主义(Corporate Capitalism)的全球版图,呼吁地理****要开展相关研究[20],但至今响应者相对不多。

梳理相关文献发现,地理学关于跨境并购的研究总体呈现“碎片化”特征。具体表现在两个方面:① 研究区域集中于少数国家或区域,研究多围绕西方发达国家/地区[21,22,23,24]及少数新兴经济体的跨境并购实践展开[5, 25],缺乏置于全球尺度的整体观测与区域差异比较;② 研究视角出现“关系转向”,但囿于母国和东道国的双边关系,往往忽视跨境并购网络或“第三国”对跨境并购的多边关系影响[26]。然而本质上讲,跨境并购是企业的全球化投资行为,且在国家间经济的相互作用下呈现网络化特征[18]。仅仅依靠上述封闭区域和二元关系的“碎片化”研究,难以完整解释具有全球特性的跨境并购网络现象,更无法捕捉跨境并购的世界地理新特征。近年来,在网络科学和地理科学的碰撞下,开始有****尝试从全球尺度基于关系与网络视角解析跨境并购这一地理现象,较好地弥补了上述研究的不足。但是,目前相关研究的侧重点尚置于网络拓扑结构变化[18, 27],而对其空间格局演化的关注度不够。

实际上,全球跨境并购网络的建构不只是国家间跨境并购拓扑联系的生成,其空间格局演化方向更在一定程度上揭示了世界资产配置权力的转移方向和全球经济要素的流动方向。从跨境并购过程来看,虽然并购方企业和标的方企业的地理位置未因跨境并购而发生改变,但标的方企业组织管理的地理位置却因跨境并购转移至并购方企业所在区域;同时,并购方企业大量资产要素也因跨境并购流向标的方企业所在区域。因此,有****将跨境并购称之为整合世界经济的最大单一手段[28]。探讨全球跨境并购网络的空间格局演化对于捕捉世界经济格局演化动向有着重要的理论和实践意义。鉴此,本文以2001—2017年全球跨境并购交易记录为数据源,构建宏观的国家间跨境并购网络,运用复杂网络分析、GIS空间技术以及引力模型等方法,刻画全球跨境并购网络的空间分布、空间联系和空间组织特征,深挖网络联系的形成机制,对全球跨境并购活动的空间格局演化进行系统分析。本文一方面有助于丰富地理学关于经济全球化与跨境并购的研究内容,另一方面有助于深入理解百年变局下世界经济地理格局演化规律,并可为中国有序推动“走出去”战略的实施提供研究支撑。

2 数据来源与研究方法

2.1 数据来源

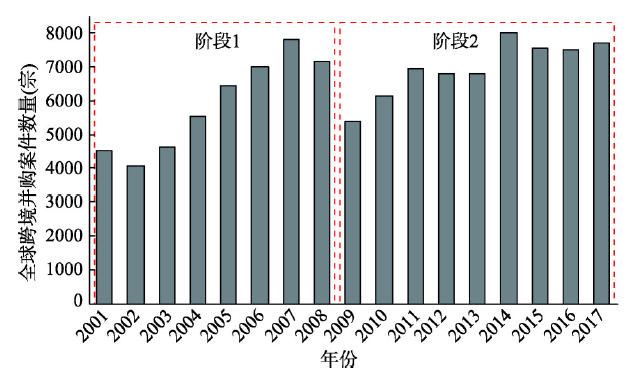

BVD-Zephyr并购数据库是国际最具影响和权威的数据库之一,收录范围广、质量高,能够全面反映全球跨境并购交易情况。本文基于BVD-Zephyr并购数据库,选取2001—2017年全球范围内已完成或预计完成( BVD-Zephyr并购数据库将正常进展且两年内未更新状态的交易定义为预计完成[5]。)的113906宗跨境并购事件,作为本研究的元数据。图1给出全球跨境并购交易活动数量的增长情况,可以看到全球跨境并购交易活动具有显著的阶段性特征,2008年是重要分界点[18]。同时亦有研究表明,2008年是新一轮并购浪潮的开端,新兴经济体崛起并成为该轮并购浪潮的热点[29]。由此,为深入理解全球跨境并购网络的演变态势,本文以2008年为时间节点将样本数据划分为2001—2008年和2009—2017年2个阶段进行对比分析。其中2001—2008年涉及48395宗跨境并购事件,2009—2017年涉及65511宗跨境并购事件。图1

新窗口打开|下载原图ZIP|生成PPT

新窗口打开|下载原图ZIP|生成PPT图12001—2017年全球跨境并购事件数量变化

Fig. 1The total number of global cross-border M&A from 2001 to 2017

2.2 网络构建

跨境并购网络属于有向加权网络。网络中,节点i代表发出跨境并购的国家(地区)(跨境并购方),节点j代表接收跨境并购的国家(地区)(跨境标的方);边fij代表国家(地区)之间的跨境并购关系,即并购方i向标的方j发起一次跨境并购,反之则为fji。由于跨境并购交易金额规模具有产业间差异,跨境并购交易的次数更能反映国家(地区)之间的并购关系。参考相关研究[18],论文采用并购频次(w)对全球跨境并购网络进行赋权。因此,国家(地区)间的跨境并购联系Fij为:为使得2001—2008年和2009—2017年2个阶段网络能够客观比较,本文对数据进行如下处理:① 对每个阶段的跨境并购联系进行年平均值计算。即:2001—2008年的每一条跨境并购联系除以8,则该阶段网络共涉及48395/8 = 6049.38条联系;2009—2017年的每一条跨境并购联系除以9,则该阶段网络共涉及65511/9 = 7279.00条联系。② 为剔除可能存在的偶然联系,本文去除了小于1的跨境并购联系。最终,2001—2008年全球跨境并购网络矩阵由99个国家(地区)和5329.75条跨境并购联系构成;2009—2017年全球并购网络由102个国家(地区)和6429.56条跨境并购联系构成。

2.3 网络测度

(1)网络节点属性测度。出度(Oi)和入度(Ti),考虑跨境并购联系的方向,分别表征国家(地区)i发出跨境并购联系的能力和接收跨境并购联系的能力,公式为:中心度(Ni),不考虑跨境并购联系的方向性,是国家(地区)i在网络中拥有跨境并购联系的总和,即出度与入度之和。中心度越高,表明国家(地区)i越居于网络核心地位,公式为:

(2)网络整体属性测度。网络密度(D),用来衡量网络联系紧密程度,网络密度越大,网络联系越紧密。有向网络中,网络密度等于有向边总数与网络最大可能边总数的比值,公式为:

式中:m是网络中实际关系总数;n是网络节点总数。

网络平均集聚系数(C),用来衡量网络联系的集聚程度,是一个节点的直接联系边数与最大可能联系边数的平均比值。公式为:

式中:n是网络节点总数;ei是节点i直接联系的边数;ki是邻接点数;ki(ki-1)是最大可能边数。

网络中心势(S),用来衡量网络联系的集中程度。有向网络中,网络中心势可分为出度网络中心势和入度网络中心势。出度网络中心势越高,跨境并购联系的发起地越集中;入度网络中心势越高,跨并购网络联系的目的地越集中。公式为:

式中:S为网络的中心势;Si为节点

网络社团,用来寻找跨境并购网络中存在的国家(地区)群体,同一社团的国家(地区)间跨境并购联系较强,不同社团国家(地区)联系相对稀疏[30]。其中,网络模块度(Q)用于衡量网络社团划分的优度。模块度越大,社团划分越合理,实际分析中,模块度一般处于0.3~0.7之间。公式为:

式中:

3 全球跨境并购网络的空间格局演化

3.1 跨境并购网络的总体特征

3.1.1 网络联系呈现增强增密的发展态势,但其增幅相对较低 2001—2017年全球跨境并购网络的节点数、边数、联系数以及网络密度等指标均有不同程度地增长。其中,参与网络建构的国家(地区)节点数量由2001—2008年的99个增长至2009—2017年的102个;边数由820条增加至988条;联系数由5237.75条增长至6429.56条;网络密度由0.085增长至0.096(表1)。表明,国家(地区)间的跨境并购联系趋于紧密,越来越多的国家(地区)主动/被动嵌入全球价值链与全球生产网络。然而,与全球跨境科技合作、人才流动、贸易流通、交通运输等网络的快速增长态势相比[31,32,33,34],全球跨境并购网络的多项指标增幅相对较低,发展趋势相对平缓。Tab. 1

表1

表12001—2017年全球跨境并购网络的统计特征量

Tab. 1

| 特征量统计 | 2001—2008年 | 2009—2017年 |

|---|---|---|

| 节点数(个) | 99 | 102 |

| 边数(条) | 820 | 988 |

| 跨境并购联系数 | 5237.75 | 6429.56 |

| 网络密度 | 0.085 | 0.096 |

| 网络平均聚集系数 | 0.472 | 0.461 |

| 出度网络中心势 | 0.585 | 0.553 |

| 入度网络中心势 | 0.327 | 0.323 |

新窗口打开|下载CSV

3.1.2 出度网络联系集中程度高于入度,但均有去中心化趋势 测量网络集聚指标发现,全球跨境并购网络联系的集聚程度出现下降。网络平均聚集系数由2001—2008年的0.472下降至2009—2017年的0.461;出度(跨境并购方)网络中心势由0.582下降至0.533;入度(跨境标的方)网络的中心势由0.327下降至0.323(表1)。表明全球跨境并购网络存在去中心化趋势,跨境并购方/标的方网络联系皆趋于扁平化。但进一步比较跨境并购方网络和跨境标的方网络发现,两个阶段出度网络中心势均明显高于入度网络中心势,这表明出度网络的联系集中程度高于入度网络,跨境并购的发起地集中于少数国家(地区),而跨境并购的目标地则不局限于某一地区,地理空间分布更加分散。

3.2 跨境并购网络的空间分布

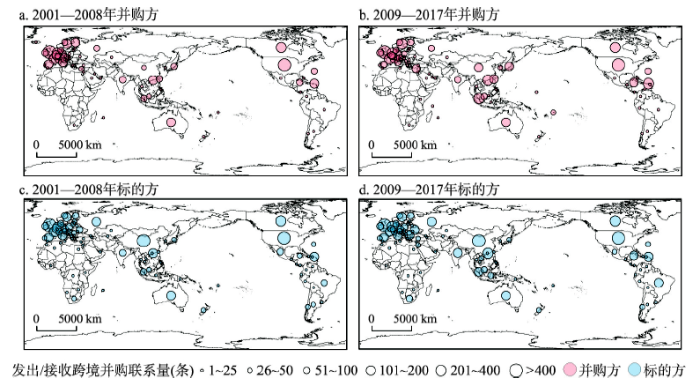

全球跨境并购方与标的方的空间分布格局虽然异质性显著,但两者空间分布重心均有自西向东转移迹象。3.2.1 跨境并购方重心朝东偏北方向移动,三极分布格局显现 2001—2008年全球跨境并购方由西欧和北美主导,呈现两极格局。全球64.16%的跨境并购方来自于北美和西欧( 本文中西欧地区范围包括法国、英国、德国、意大利、比利时、荷兰、爱尔兰、卢森堡、希腊、西班牙、葡萄牙和丹麦12国;北美地区包括美国和加拿大2国。),其中,美国发出跨境并购联系1061.62条,占全球总数的19.93%,是世界上最大跨境并购方,其次为英国596.38条(占比11.19%)、加拿大347.38条(6.52%)、德国300.00条(5.63%)、法国293.25条(5.50%)等。2008—2017年全球跨境并购方的空间分布格局发生较大变化。西欧和北美虽仍具先发优势,但其全球份额出现下降,发出跨境并购联系总量占全球比重缩减至52.11%;与之相反,东亚、东南亚的全球份额大幅提升,发出跨境并购联系总量占全球比重攀升至18.06%(2001—2018年为8.83%)。该结果导致全球跨境并购方的空间分布重心发生改变,标准差椭圆中心点坐标由2001—2008年的38°9'49''N、11°41'30''W,向东偏北方向移至41°56'22''N、0°21'22''E(表2)。中国是全球发出跨境并购联系的增量最大的国家,2008—2017年中国发出跨境并购联系量达187.22条,相对2001—2008年的35.88条,增长151.35条,增幅521.87%。此外,东亚、东南亚区域增幅较高的国家(地区)还有新加坡(增幅为139.50条)、日本(117.58)、中国香港(116.06)、中国台湾(81.40)、韩国(34.42)、马来西亚(31.18)等。东亚、东南亚区域之外,英属维京群岛、塞浦路斯、开曼群岛、卢森堡等国家(地区)发出跨境并购联系的能力也有大幅提升。整体而言,2001—2017年,伴随亚太地区发出跨境并购联系能力的提升,全球跨境并购方的空间分布重心向东偏北方向移动,西欧、北美、亚太三极核心格局显现(图2a、图2b)。

Tab. 2

表2

表22001—2017年并购方和标的方的空间分布重心(标准差椭圆中心)测度

Tab. 2

| 参数 | 并购方 | 标的方 | |||

|---|---|---|---|---|---|

| 2001—2008年 | 2009—2017年 | 2001—2008年 | 2009—2017年 | ||

| 中心纬度 | 38°9′49″N | 41°56′22″N | 39°12′6″N | 36°22′37″N | |

| 中心经度 | 11°41′30″W | 0°21′22″E | 3°12′9″E | 9°47′35″E | |

| 方向角度 | 95.12° | 94.71° | 94.44° | 95.61° | |

| 扁率 | 0.74 | 0.76 | 0.69 | 0.70 | |

新窗口打开|下载CSV

图2

新窗口打开|下载原图ZIP|生成PPT

新窗口打开|下载原图ZIP|生成PPT图22001—2017年跨境并购方和标的方的时空分布

注:基于自然资源部标准地图服务网站审图号为GS2016(1666)号的标准地图制作,底图边界无修改。

Fig. 2Spatial distribution evolution of cross-border acquirers and targeters from 2001 to 2017

3.2.2 跨境标的方重心朝东偏南方向扩展,多极分布格局凸显 2001—2008年全球跨境并购标的方主要分布于北回归线以北地区,呈现西欧、中国、北美三足鼎立之势。美国(接收跨境并购联系729.50条)、英国(488.38)、中国(410.63)、德国(357.75)、法国(261.88)是全球跨境并购的五大标的方,五国接收跨境并购联系总量占全球比重达到42.29%。2009—2017年全球跨境并购标的方的空间分布格局由北向南拓展,北回归线及其以南国家(地区)的跨境并购标的热度提升,空间分布重心(标准差椭圆中心点)坐标也由2001—2008年的39°12'6''N、3°12'9''E,向东偏南方向移至36°22'37''N、9°47'35''E(表2)。中国香港是全球接收跨境并购联系量增幅最大的地区,2009—2017年跻身世界第五大跨境并购标的方,接收跨境并购联系268.67条,相对于2001—2008年的120.00条,增长148.67条,增幅123.33%。此外,北回归线及其以南地区接收跨境并购联系量增幅较高的国家(地区)还有东南亚的新加坡(接收跨境并购联系量增长70.06条)、马来西亚(59.22)、印尼(34.57)、越南(28.78),南亚的印度(34.74),加勒比海地区的英属维京群岛(81.36)、开曼群岛(72.93),南美洲的巴西(58.61)以及非洲的南非(9.38)等。整体而言,2001—2017年全球跨境标的方基本锁定于欧洲、北美和亚太三核心,但伴随南方国家(地区)标的热度地上升,其空间分布格局由北向南更加多中心化(图2c、图2d)。

3.3 跨境并购网络的空间联系

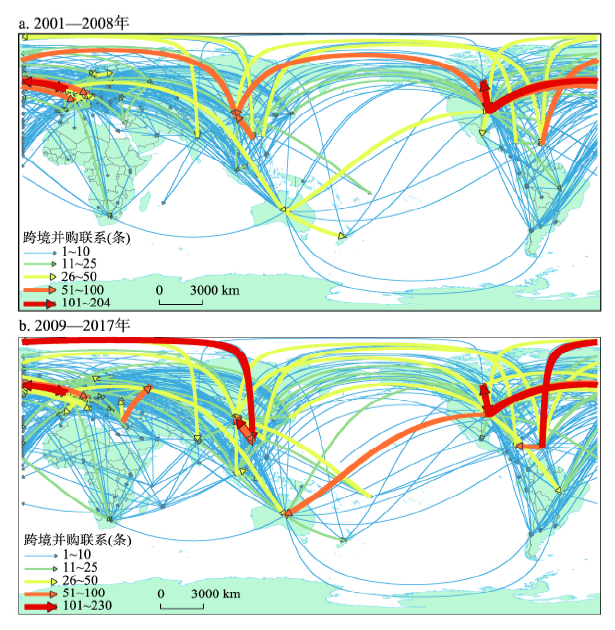

全球跨境并购网络的空间联系演化兼具路径依赖与路径创造。其中,北美西欧始终主导全球跨境并购网络,美国—西欧互购也始终为网络联系主轴线;2008年金融危机后,中国为首的亚太地区结网能力增强,发出跨境并购联系的能力大大提升。3.3.1 北美西欧始终是跨境并购网络的主导 网络中大规模的跨境并购联系多发生于美国和加拿大,以及美国和西欧的英国、法国、德国等国家之间。2001—2008年全球规模最大的10条跨境并购联系中,8条与美国及西欧国家有关(图3a)。其中,加拿大→美国的跨境并购联系规模世界第一,达到203.75条;此后依次为美国→英国(193.13)、美国→加拿大(169.13)、英国→美国(153.00)、美国→德国(82.13)、美国→中国(61.87)、美国→法国(60.65)、英国→德国(46.63)等。2009—2017年网络中大规模的跨境并购联系保持较强的时空惯性和路径依赖,美国→英国(230.00)、加拿大→美国(192.00)、美国→加拿大(186.33)、英国→美国(129.44)以及美国→德国(80.33)这5条联系依旧稳定位居全球10大跨境并购联系之列。美欧关联之外,美国、西欧国家由北向南的跨境并购联系规模增加。例如,英国加强了对澳大利亚的跨境并购联系,美国加强了对澳大利亚、印度、巴西等国家(地区)的跨境并购联系(图3b)。综合来看,北美和西欧长期主导全球跨境并购网络联系格局,且形成美国—西欧网络互购核心主轴线。

图3

新窗口打开|下载原图ZIP|生成PPT

新窗口打开|下载原图ZIP|生成PPT图32001—2017年全球跨境并购网络的空间联系格局

注:基于自然资源部标准地图服务网站审图号为GS2016(1666)号的标准地图制作,底图边界无修改。

Fig. 3Spatial contact pattern of global cross-border M&A from 2001 to 2017

3.3.2 中国的亚太区域中心地位进一步增强 中国一直是亚太地区最受欢迎的跨境并购联系中心。2001—2008年中国以接收跨境并购联系为主,是亚太地区接收能力最强的国家,也是全球除欧美之外的主要跨境标的方(图3a)。该阶段,中国接收跨境并购联系的总量占东亚和东南亚地区接收总和的55.54%。其中,中国香港→中国(跨境并购联系量为91.63条)、英属维京群岛→中国(65.75)、美国→中国(61.88)以及开曼群岛→中国(33.00)4条跨境并购联系跻身全球前20强(亚太地区共有5条跨境并购联系进入前20强,另外一条为英属维京群岛→中国香港)。2009—2017年亚太地区结网增强增密,中国在亚太的区域中心地位得到进一步巩固(图3b)。一方面,全球前20强跨境并购联系中涉及亚太国家(地区)的增至9条,中国独占6条,分别为中国香港→中国(143.44)、中国→中国香港(65.56)、中国台湾→中国(49.67)、新加坡→中国(45.89)、英属维京群岛→中国(45.00)、开曼群岛→中国(40.78)。另一方面,中国发出跨境并购联系的能力与范围增强,中国对外建立稳定跨境并购联系的国家(地区)数增至30个(2001—2008年仅为10个)。但值得注意的是,美国与中国存在“脱钩”现象,2009—2017年美国→中国的跨境并购联系量仅为28.78条,远低于2001—2008年的联系水平(61.87条);中国→美国的跨境并购联系量较前一阶段有所上涨,但也仅为22.22条。综合来看,中国始终是亚太区域跨境并购网络的增长极,且其角色正在以接收跨境并购联系为主,转向接收和发出并重。然而,本文认为中国的全球跨境并购联系也存有一定问题,① 中国的跨境并购联系来源锁定于中国香港、新加坡、英属维京群岛、开曼群岛等地区,发出依赖于中国香港(2009—2017年中国→中国香港联系量占中国发出总量的35.01%)。② 中美跨境并购关系减弱,且与两国体量不相符合。

3.4 跨境并购网络的空间组织

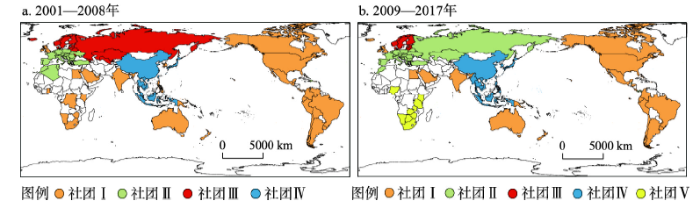

全球跨境并购网络的空间组织演化具有显著的空间粘滞性和区域依赖性特征,社团空间组织范围总体与世界大洲/大区范围相吻合。3.4.1 网络的空间组织具有地理邻近聚集特征 2001—2017年全球跨境并购网络的社团分布呈现“大块集聚,小块分散”的地理空间格局,社团边界较为清晰,地理邻近集聚特征较为明显。美洲、大洋洲、欧洲、东亚、南非等大洲/大区的社团构成整体上保持较好的单一性,社团之间的混杂度不高(图4)。表明全球跨境并购网络联系的空间组织模式以扩展扩散为主,跳跃扩散为辅。同时,与人才迁移网络[34]、技术转移网络[35]等同属社会活动流的“软”网络相比,全球跨境并购网络社团的地理空间组织未能大规模突破地理距离的约束,以连续式、邻近式的社团子网联系为主要特征,该结果反而类似于由地理距离驱动的铁路网络和公路网络[36]等“硬”网络的社团组织特征。

图4

新窗口打开|下载原图ZIP|生成PPT

新窗口打开|下载原图ZIP|生成PPT图42001—2017年全球并购网络社团的空间组织格局

注:基于自然资源部标准地图服务网站审图号为GS2016(1666)号的标准地图制作,底图边界无修改。

Fig. 4Spatial organization pattern of community for global cross M&A network from 2001 to 2017

3.4.2 网络的社团构成存在分裂整合演变进程 2001—2008年网络被划分为4个社团,模块度达到0.326。其中,社团Ⅰ主要以英美为主导,由美洲、大洋洲、非洲和印度次大陆的国家(地区)凝聚构成;社团Ⅱ主要以德法为主导,由欧洲地中海沿岸区域的国家(地区)凝聚构成;社团Ⅲ主要以俄罗斯主导,由独联体和北欧等国家(地区)构成;社团Ⅳ主要以中国为主导,由亚洲东部区域和加勒比海区域凝聚构成(图4a)。2009—2017年网络分裂整合为5个社团,模块度为0.364。其中,原英美主导的社团Ⅰ的凝聚范围缩小,分裂成为美洲—大洋洲—印度社团Ⅰ和非洲南部社团V;原德法主导的社团Ⅱ吸收俄罗斯及其他独联体国家(地区),整合组成地中海地区—独联体区域社团Ⅱ,而原俄罗斯主导的社团Ⅲ则仅剩北欧5国以及波罗的海3国;原中国主导的社团Ⅳ吸收韩国和菲律宾,凝聚范围进一步扩展(图4b)。总体来看,2001—2017年全球跨境并购网络的社团构成范围存在整合分裂的演变进程,英美主导的社团虽仍为全球最大的社团但其凝聚范围已经出现收缩,而中国主导的亚太社团范围得到一定程度扩展,德法主导的社团进一步对欧洲国家(地区)进行整合。

4 全球跨境并购网络的形成机制

为深入探讨网络空间格局演化的内在原因,本文构建引力模型采用负二项回归方法对全球跨境并购网络的形成机制进行定量分析。4.1 指标选取

根据空间相互作用理论[37],跨境并购联系的形成既受制于国家(地区)之间的阻碍力,也受制于跨境并购方国家(地区)推力和标的方国家(地区)拉力。跨境并购联系的阻碍力由两地邻近关系决定,地理、语言、历史以及经济的邻近性会影响国家(地区)间跨境并购联系的形成。地理的邻近益于减少跨境并购方和标的方之间的时空成本,便于两地资源、技术以及市场的共享与开发,能够促进国家(地区)间跨境并购联系的产生[38]。语言的邻近利于降低跨境并购双方企业的沟通成本,减少并妥善解决并购联系过程中的摩擦,进而推动跨境并购交易的达成[39]。历史的邻近有助于使参与跨境并购联系的两国(地区)企业拥有相同的惯例、制度和规范[15],增强并购投资的信任。经济邻近对跨境并购联系的影响主要体现在发达国家(地区)之间跨境并购联系更频繁,且已有研究表明经济的邻近对于国际投资、贸易、科研合作有重要影响[39,40,41]。因此,本文也将经济邻近性指标纳入模型。

跨境并购联系的推力和拉力由国家(地区)属性决定,传统区位论认为资源寻求、市场寻求、技术寻求是企业开展国际投资的三大动机[3, 42]。地理资源空间分布的有限性决定,当国内自然资源、技术资源、市场资源等要素变得稀缺或成本上升,本地企业便会跨越国家(地区)边境,通过并购的方式快速进入东道国获取自然、技术以及市场等资源,继而实现利益最大化。因此,本文选取自然资源禀赋、科技发展水平以及经济市场规模作为国家(地区)属性的衡量指标。此外,鉴于离岸金融中心在国际资本流动中具有重要作用,跨国企业会为规避国家(地区)管制而绕道离岸金融中心[43],因此本文也将其纳入模型作为控制变量。

4.2 模型构建

跨境并购联系量为非负整数,且被解释变量存在“过度离散”现象。考虑跨境并购联系的方向性,本文构建引力模型并采用负二项方法对模型估计:式中:α是常数项。被解释变量MAij为国家(地区)i对国家(地区)j的跨境并购联系量。邻近性指标中,GEORPOij表示国家(地区)i与国家(地区)j的地理邻近性,以两国(地区)首都/首府之间的球面距离衡量,为减少该指标数据存在的波动性,取其对数形式;LANRPOij表示国家(地区)i与国家(地区)j的语言邻近性,即两国(地区)拥有相似的语言赋值为1,否为0;HISRPOij衡量国家(地区)i与国家(地区)j的历史邻近性,即两国(地区)具有共同宗主国赋值为1,否为0,其中2001—2008年参与网络建构的国家(地区)样本中,占比14.14%的国家(地区)互有相同的殖民历史,2009—2017年为26.47%;ECORPOij衡量国家(地区)i与国家(地区)j的经济邻近性,即根据世界银行的国民收入水平分组进行评判,同属一组赋值为1,否则为0。属性指标中,TEC表示国家(地区)科技发展水平,以专利合作条约(Patent Cooperation Treaty,PCT)专利申请总量衡量;NRR表示国家(地区)自然资源赋存程度,采用自然资源租金占GDP比重衡量;GDP衡量国家(地区)经济市场规模大小,为减少该指标数据存在的波动性,取其对数形式;OFC反映国家(地区)是否为离岸金融中心,若是赋值为1,不是为0;ε是随机误差项。由于本文采用分时段研究全球跨境并购网络的空间格局演化,因此参考相关研究[15, 44]采用各个时段变量的平均值进行回归。上述指标数据主要提取于法国CEPII数据库、世界银行数据库、世界知识产权组织专利数据库以及国际清算银行数据库。

4.3 回归结果

为确保模型准确对模型进行检验,两个阶段的模型VIF值最高为2.52,均不存在多重共线性问题;模型参数Alpha值不等于0,且因变量均在1%上具有显著性水平。综合表明,模型构建正确,具有较强解释力。模型估计结果如表3所示。Tab. 3

表3

表32001-2017年全球跨境并购网络形成机制的负二项回归结果

Tab. 3

| 自变量 | 2001—2008年 | 2009—2017年 |

|---|---|---|

| lnGEORPOij | -0.254*** (0.030) | -0.266*** (0.029) |

| LANRPOij | 0.555*** (0.079) | 0.563*** (0.074) |

| HISRPOij | 0.657*** (0.194) | 0.720*** (0.158) |

| ECORPOij | 0.134* (0.080) | 0.026 (0.071) |

| TECi | 0.000*** (0.000) | 0.000*** (0.000) |

| TECj | 0.000** (0.000) | 0.000*** (0.000) |

| NRRi | -0.020** (0.009) | -0.033*** (0.009) |

| NRRj | 0.001 (0.009) | 0.002 (0.009) |

| lnGDPi | 0.049* (0.027) | 0.007 (0.021) |

| lnGDPj | 0.258*** (0.026) | 0.117*** (0.022) |

| OFCi | 0.276** (0.110) | 0.301*** (0.098) |

| OFCj | 0.304** (0.127) | 0.405*** (0.110) |

| 常数项 | -5.093*** (1.033) | -0.225 (0.842) |

| lnalpha | -0.425*** (0.060) | -0.322*** (0.052) |

| 关系数 | 808 | 979 |

| Prob > chi2 | 0.000 | 0.000 |

| Log likelihood | -2161.0689 | -2644.2496 |

新窗口打开|下载CSV

(1)邻近关系方面。2001—2017年地理邻近性、语言邻近性以及历史邻近性都有利于跨境并购联系的形成;经济邻近性对跨境并购联系形成的影响在2009—2017年转向失效。其中,地理邻近性方面,国家(地区)间的地理距离与跨境并购联系量显著负相关,表明地理距离对国际跨境并购联系的阻抗效应明显,这与Di等对欧洲跨境并购网络研究的结果一致[15],“流空间”背景下国家(地区)间的地理距离仍是影响跨境并购联系形成的重要因素,因为地理邻近能够增强企业并购联系的效率和频率,减少信息不对称;语言邻近性方面,两个阶段模型显示语言邻近性指标显著为正,表明语言的相似性益于跨境并购交易的达成。这与杨文龙等对国际投资网络研究的结果相似[39],相似语言的使用能够减少企业跨境并购的交流障碍,降低错误信息传递带来的风险,进而推动双边并购关系形成。历史邻近性方面,两个阶段模型的历史邻近性指标显著为正,表明拥有曾/现拥有共同宗主国的国家(地区)之间更容易发生跨境并购。原因是跨境并购双方相同的历史文化能够减少跨境并购交易的社会文化成本,利于交易的完成。这一结果也为中国香港和英属维京群岛,新加坡和马来西亚等(它们均曾/现为英国属地/殖民地)为什么会建立紧密并购关系提供了非正式制度因素的解释;经济邻近性方面,经济邻近性指标在2001—2008年显著为正,而在2009—2017年不显著。表明2001—2008年间跨境并购更容易发生在经济发展水平接近的国家(地区)之间,特别为高经济水平国家(地区)之间。然而,这一现象在2009—2017年被打破,跨境并购联系不再仅是“经济大国游戏”,跨境并购联系既发生在经济发展水平相似(以发达国家为主)的国家(地区)之间,也发生在不同经济发展水平的国家(地区)之间,两者共同推动网络的形成与演化。

(2)国家(地区)属性方面。2001—2017年科技发展水平和离岸金融中心始终是跨境并购联系形成的双向(发出和接收)积极影响因素;而自然资源和经济市场规模仅对跨境并购联系产生单向(发出或接收)影响。其中,科技发展水平方面,国家(地区)科技发展水平越高,越有利于跨境并购联系的接收和发出。这表明科技已成为推动全球跨境并购网络演化的重要驱动力之一,该结果与波士顿咨询公司的报告结论一致:“科技”正在引领全球并购浪潮,自2012年起国际科技并购数量和金额的增速已远超整体并购市场的发展速度,2016年科技并购总额超过7000亿美元,几乎达到全球并购整体市场的30%[45];离岸金融中心方面,离岸金融中心对发出和接收跨境并购联系的影响显著为正,表明离岸金融中心已成为全球跨境并购网络的重要中转中心。究其原因,离岸金融中心特殊的制度政策及其大量的优惠措施为跨国企业规避东道国/母国管制,进行避税、资产转移、海外融资、借壳上市、迂回投资等提供了空间[43],进而成为网络中跨境并购联系重要的中转中心;自然资源方面,2001—2017年国家(地区)自然资源租金占GDP比重对发出跨境并购联系产生了负向影响,这可能是因为资源大国易于满足本土企业的资源需求,进而对企业跨境资源寻求形成阻力;而对接收跨境并购联系影响不显著,表明资源寻求并非该阶段企业跨境并购联系的主要动机。根据联合国数据库跨境并购行业数据显示,2001—2017年年均发生在初级行业(农、林、渔、矿、采石以及石油业)的跨境并购交易数量占比仅为4.10%;经济市场规模方面,国家(地区)GDP仅在2001—2008年对跨境并购联系产生双向积极影响,而在2009—2017年只对跨境并购联系的接收产生显著正向影响,对发出影响不显著。这表明,经济市场规模较大的国家(地区)对企业具有吸引力,是拉动跨境并购联系进入的重要因素。2008年金融危机后,新兴经济体崛起成为拉动国际并购投资的引擎,经济市场较小的国家(地区)(如东南亚国家)发出跨境并购联系能力提升,经济市场规模指标对发出跨境并购的影响力转向失效。

5 结论与讨论

本文基于BVD-Zephyr跨境并购数据库数据建构网络,利用复杂网络分析、GIS空间技术以及引力模型等方法,对全球跨境并购网络的空间格局演化及其形成机制进行综合探讨。研究发现:(1)全球跨境并购网络趋向稠密化与多中心化,网络联系的规模、强度、密度等指标均有不同程度增长。然而,相比于全球跨境科技合作、人才流动、贸易流通、交通运输等网络的快速增长态势[31,32,33,34],全球跨境并购网络的各项指标增幅并不高,表明跨境并购联系所遇国家(地区)境界的障碍要大于国际知识流、交通流、商品流等。

(2)伴随亚太地区跨境并购能力的提升,跨境并购网络的全球版图出现重塑。尽管北美和西欧始终是全球跨境并购方和标的方的集聚核心,且构建了西欧—北美网络并购核心轴线,但其影响力在2009—2017年出现下降,美英主导的网络社团凝聚范围也随之缩小。与之相反,亚太地区在网络中的影响力上升,并成为拉动全球跨境并购市场增长的新引擎。中国是亚太地区影响力上升的首要推动者,其角色已从由全球跨境并购网络的被动接受者转变为积极参与者。但需注意,中国的跨境并购联系虽有路径创造但更具路径依赖,中国香港、英属维京群岛、开曼群岛等离岸金融中心是其重要的标的方或收购方。

(3)全球跨境并购网络的形成受跨境并购方和标的方国家(地区)属性因素、以及两者之间邻近性因素的共同推动。国家(地区)属性因素方面,科技发展水平一直是跨境并购联系形成的双向(发出和接收)积极力量;而自然资源赋存程度对跨境并购联系的发出产生了显著负向影响;经济市场规模在2001—2008年对网络演化具有双向积极影响,而2009—2017年只对跨境并购联系的接收产生正向拉力;此外,离岸金融中心对跨境并购联系的形成也产生了的双向积极影响因素,与预期相符。邻近性因素方面,地理邻近性、语言邻近性以及历史邻近性始终是推动全球跨境并购网络形成的有利因素;经济邻近性仅在2001—2008年期间对网络形成具有显著正向影响,而在2009—2017年显著性水平失效,证明2008年金融危机后,全球跨境并购网络中“强—强”跨境互购的富国圈被打破,“强—弱”跨境并购联系也推动了网络的形成。

(4)世界正处百年未有之大变局,世界经济地理的整体格局正在或即将出现系统性重构。跨境并购作为整合和重塑世界经济地理的重要变量,对其空间格局的审视有助于理解世界经济格局的演变动向。研究表明全球跨境并购网络的重心由西(欧美)向东(亚太)发生移动,一定程度上表明世界经济资源和资产配置的重心正在由西向东移动。该结果也进一步辅证了麦肯锡公司、Quah等关于世界经济重心东移的报告/研究[46,47]。中国是全球跨境并购网络重心转移的最大推动力,其网络角色正由被动参与者向主动建构者转变。2008年金融危机之前,中国主要通过资源和市场换取技术,“对外引资引智”成为世界工厂;2008年之后,越来越多的中国企业通过跨境并购的方式“走出去”,“对外投资投智”汲取国际资源并实现赶超。然而,本文认为“重心东移”尚是一种迹象,全球跨境并购体系并没有出现实质性改变。尽管全球资本的流入地区(标的方)趋于更加分散,但网络控制权(并购方)仍牢牢掌握在少数国家(地区)手中,尤以欧美发达国家(地区)为主。因此,实施更加积极的开放政策,鼓励中资企业通过跨境并购等方式进一步“走出去”,在增强同欧美发达国家(地区)深度并购合作的同时,基于“一带一路”倡议拓展与沿线国家(地区)投资合作空间,是中国应对世界百年变局的有效手段。

(5)本文存在局限和进一步研究空间。① 研究尽可能还原全球跨境并购网络的实际情况,但部分企业迂回离岸金融中心以及借助东道国子公司的跨境并购行为,不可避免地掩盖了部分事实,本文难以识别及剔除该部分数据。② 全球跨境并购网络不仅发生在国家(地区)间,也发生于城市间,多尺度的全球跨境并购网络分析应是未来研究方向之一。③ 世界正处百年变局之中,全球地缘、宗教、疾病等多重复杂因素均会对跨境并购具有重大影响,从不同视角考察全球跨境并购网络的影响机制亟待展开。④ 不同行业的跨境并购具有差异性,也会形成不同跨境并购网络空间格局。当前高科技行业跨境并购交易正成为一种全球潮流,探究不同行业特别是高科技行业的跨境并购将更具重要意义。

参考文献 原文顺序

文献年度倒序

文中引用次数倒序

被引期刊影响因子

[本文引用: 1]

[本文引用: 1]

DOI:10.1093/jeg/3.3.309URL [本文引用: 4]

[本文引用: 2]

[本文引用: 2]

[本文引用: 1]

[本文引用: 1]

DOI:10.18306/dlkxjz.2019.10.006 [本文引用: 3]

<p id="C3">Under the background of booming regional integration, studying cross-border mergers and acquisitions (M&As) of enterprises can help understand capital flow in regions of different scales. This study used the BVD-Zephyr cross-border M&As data of Chinese enterprises from 2003 to 2017 to explore the accomplishment rate and transaction scale of cross-border M&As from the perspective of regional integration and institutional distance. Through Heckman's two-stage regression, this study found that: 1) Regional integration can promote the closing of cross-border M&A deals, but does not contribute to an increase in the amount of M&A transactions. 2) Rising formal institutional distance (significant differences of laws and regulations) helps close the deals, but it is not conducive to expand the scale of transaction. 3) Decreasing informal institutional distance (disparities of culture and identity) is able to assist the completion of transactions, but as long as the deal is done, it has larger amount. Besides, with the deepening of regional integration, formal institutional distance between the members is believed to be attenuated, which leads to a decreasing difficulty of closing deals and the hindrance of institutional distance to the transaction scale will be weakened.</p>

[本文引用: 3]

DOI:10.18306/dlkxjz.2017.11.011 [本文引用: 2]

<p>Cross-border and domestic mergers and acquisitions (M&As) have undergone a rapid growth in recent years, which has facilitated the mobility of various elements across different regions and sectors. Therefore M&As are considered an important impetus and solution for the optimization of enterprise organization, industrial transformation, and spatial restructuring, as well as regional integration and sustainable development. Since the 1950s, there has been a vast literature straddling the boundaries of economics, enterprise managerialics, international trade studies, and economic geography on M&As. The literature mainly focused on three perspectives, namely organizational perception, interaction or networks perspective, and a contextual or spatial view of the firms involved in M&As. Taking advantage of theories and methodologies in relevant research fields, such as location theory, corporate geography, industrial agglomeration, and global production networks and proximity, scholars have done much effective empirical work on this issue. First, the spatiotemporal pattern and contacting networks of M&As have been investigated in various spatial scales, such as worldwide, inter-countries, and inter- and intra-regions. Second, deriving related theories, the literature focused on the driving factors and dynamic mechanism of M&As, especially the heterogeneities of enterprise characteristics, industrial attributes, and locational context. Third, the literature has paid increasing attention to the locational implications of M&As for corporate performance, public welfare, industrial transformation, and regional development, and the spatial consequences of M&As is a hotspot for related studies. Although cross-border and domestic M&As taken by Chinese corporates are increasingly frequent since the global financial crisis, research on M&As from spatial and geographical perspectives in China is far from sufficient. Therefore, this literature review focuses on the progress in theoretical perspectives and empirical research on M&As, and explores the implications and agendas for further research on M&As in a transitional China.</p>

[本文引用: 2]

[本文引用: 2]

[本文引用: 2]

DOI:10.1016/j.ibusrev.2013.02.003URL [本文引用: 1]

[本文引用: 1]

[本文引用: 1]

DOI:10.1111/joms.2000.37.issue-3URL [本文引用: 1]

DOI:10.5465/amj.2005.19573109URL [本文引用: 1]

[本文引用: 1]

[本文引用: 1]

DOI:10.1002/tie.v55.1URL

[本文引用: 1]

[本文引用: 1]

DOI:10.1111/twec.2016.39.issue-6URL [本文引用: 4]

DOI:10.1016/j.intman.2004.05.005URL [本文引用: 1]

DOI:10.1111/j.1540-6261.2012.01741.xURL [本文引用: 1]

DOI:10.11821/dlyj020190168 [本文引用: 5]

<p id="C3">Cross-border mergers and acquisitions (M&A) are one of the important globalization strategies of multinational corporations. Using data from Zephyr global M&A database, this study built the global cross-border M&A network from 1997 to 2017 and analyzed the evolution of topology characteristics and structure. The analysis results are as follows. (1) Since the 1990s, global cross-border M&A have developed in a fluctuating manner. The topological characteristics show different features at different points, of which the global financial crisis in 2008 was an important turning point. (2) The small world characteristic of the global cross-border M&A network is prominent. The network is scale-free, and rich-club phenomenon of the acquiring party is more obvious than that of the acquired party. However, the rich-club phenomenon of both shows a decrease as the process of economic globalization with more and more developing countries/regions participating in the competition of cross-border M&A market. (3) The global cross-border M&A network shows a “core-edge” structure. The center has gradually transformed from dual-core (North America and Western Europe) structure to “global triangle” structure since the global financial crisis in 2008, of which East Asia and Southeast Asia constitute the third core. Nevertheless, Africa, South America and parts of Asia are the persistent peripheries. (4) Countries/regions play a different role in the global cross-border M&A network, so they can be divided into outward or inward in terms of net capital flow and core, active or potential players in terms of the scale of cross-border M&A. The performance of different countries/regions has changed a lot in 1997-2017, especially European regions. (5) Although some countries (Singapore, Poland, Czech, United Arab Emirates, etc.) become more and more important in the global cross-border M&A network, countries along the Belt and Road as a whole are not active in cross-border M&A, most of which are in a position of the edge. (6) China has grown from a potential player to a core player by attracting foreign investment and encouraging capital exports, but the link between China and Belt and Road countries in the aspect of cross-border M&A is weak and should be strengthened appropriately on the basis of host country’s resource endowment, industrial development, and institutional environment.</p>

[本文引用: 5]

[本文引用: 1]

DOI:10.1068/a210997URL [本文引用: 1]

DOI:10.1111/tesg.2006.97.issue-3URL [本文引用: 1]

DOI:10.1080/00343404.2015.1007936URL [本文引用: 1]

[本文引用: 1]

DOI:10.1080/00343400050192847URL [本文引用: 1]

DOI:10.1093/jeg/lbt022URL [本文引用: 1]

DOI:10.13249/j.cnki.sgs.2017.09.002 [本文引用: 1]

Using complex network analysis, this study applied GIS, Pajek, Matlab and database, etc., to build the global transnational investment relationship network, and analyzed the temporal evolution of the spatial structure and network complexity of the global transnational investment network from 2001 to 2012. The results shows: 1) The global transnational investment network is showing a “core-edge” ring structure, whose inner structure is changing and reorganizing. The investment network transformed from dual-core (North America and Western Europe) structure into overlapped and related multi-core (North America, Western Europe, the Caribbean, Eastern Asia and Australia) topological structure, with capital gradually flowing from Western Europe, North America, and Eastern Asia to Northern Europe, South America, West Asia and Southeastern Asia in the macroscopic view. 2) The small-world characteristic of the investment network is prominent. The network is scale-free and shows a decrease overtime. 3) The countries that are active in the investment have higher control of the transnational investment network. The confounding factors influence the spatial reachability of the transnational investment. 4) Ranked by the complexity (dissimilarity) of the transnational investment structure, the result from high to low is terminal invest countries, regional invest countries, normal invest countries and isolated investment countries. Countries with different functional types have a clear trend of clustering.

[本文引用: 1]

[本文引用: 1]

[本文引用: 1]

DOI:10.1016/S1075-4253(99)00014-9URL [本文引用: 1]

[本文引用: 1]

[本文引用: 1]

[本文引用: 1]

DOI:10.11821/dlxb201812003 [本文引用: 2]

The concept of megalopolis, since its original inception six decades ago, has inspired many new terms that mainly describe large-scale urbanized forms such as megaregions and polycentric urban regions. However, recent studies have increasingly focused on the two key functions that megalopolises act as an incubator of new ideas and trends and as a hub that articulates knowledge exchange at the megalopolitan, national, and global scales. While the recent studies have mainly analyzed the functional aspects of megalopolis based on China's Yangtze River Delta region, this paper investigates the evolving process and mechanisms of knowledge collaboration within and beyond Guangdong-Hong Kong-Macao Greater Bay Area (GBA) - one of the most promising and vibrant megalopolises in China. In addition, the GBA megalopolis is unique because it contains Hong Kong and Macao, which have a different political system from China's mainland. Drawing upon a dataset of publications that were indexed in Web of Science Core Collection during the 1990-2016 period, this paper uses the Gini coefficient to measure the degree of knowledge polycentricity of the GBA megalopolis. Here, knowledge polycentricity is further classified into attribute polycentricity of knowledge production and functional polycentricity of knowledge collaboration within and beyond the GBA megalopolis. Whereas the attribute polycentricity refers to the distribution inequality of the total publications of GBA cities, the functional polycentricity represents the distribution inequality of GBA cities' knowledge collaboration at different geographical scales. Our empirical results show: (1) knowledge production of the GBA megalopolis as a whole has experienced a robust and continuous growth. The degrees of both attribute polycentricity and functional polycentricity have also been on the increase in general, although there are some fluctuations in early years and some deviations in recent years. During the ten years after Hong Kong and Macao returned to China (the 2000-2010 period), the degree of knowledge polycentricity of the GBA megalopolis especially enjoyed the fastest rise; (2) The degree of functional polycentricity decreased with the expansion in the geographical scales at which it is measured, confirming the findings of previous studies that functional polycentricity is scale-dependent. Moreover, we find that the degree of functional polycentricity becomes more fluctuated at the global scale while it tends to increase continuously at the megalopolitan scale; (3) The evolving process of knowledge polycentricity of the GBA megalopolis is influenced by institutional proximity, geographical proximity and status proximity between cities. Specifically, the mobility of researchers, the collaboration of universities and research institutes, and the coordination of local governments are three major forces promoting the evolution of knowledge polycentricity of the GBA megalopolis. Overall, the increasing knowledge polycentricity would be of significance for the GBA megalopolis to form a knowledge-driven region of collective collaboration.

[本文引用: 2]

DOI:10.1016/j.geoforum.2019.06.017URL [本文引用: 2]

DOI:10.11821/dlyj201803004 [本文引用: 2]

The paper, from the perspective of social network, explores the spatial patterns and evolutionary characteristics of the global trade network and focuses on the Chinese community ownership and their strategic implications by adopting social network indexes, including centrality, community classification and structure entropy. The results show that: (1) The structure of global trade network evolved towards complexity, specifically shifted from "one super state and more powerful countries" towards"multi-polarization". The collective rise of developing countries has weakened the monopoly position of traditional European and American countries in the network, leading to increasing complexity of the network structure. (2) Community evolution of the global trade network has experienced the dominant stage of the developed countries, the budding stage of the Asian region, the separated stage of the Asian Community and the fourth stages of "ripartite confrontation". During the evolution, China has gradually moved from being dominated to the center of the stage. (3) The diversification of trade market is a common characteristic of foreign trade countries. In the process of global market segmentation, China, the United States, and Germany gradually formed a relationship of "dislocation competition", and their core interests are concentrated around the surrounding areas. (4) The areas of Asia-Pacific Region, Middle East, Africa and Latin America have become the play field of China to compete other powers for local trade markets. Currently, the Asia-Pacific market is the preferred market for China's global trade, and China should extend the market to the Middle East, Africa and Latin America through "Silk Road Economic Belt and 21st Century Maritime Silk Road", In this way, economic advantage can be transformed into global strategic influence. Meanwhile, direct conflicts and confrontations with the core interests of the United States should be avoided.

[本文引用: 2]

DOI:10.11821/dlyj020181156 [本文引用: 3]

High-quality talents are reshaping the world economic landscape by transcending geographic flows and driving global innovative activities. Based on the data of international student mobility, this paper draws on complex network theory to construct a multidimensional weighted directed network heterogeneity model. This model uses the GIS spatial analysis method to study spatiotemporal evolution of global talent mobility network complexity from 2001 to 2015. The results are as follows. First, the scale of the global talent mobility network is expanding rapidly, and the relationship is becoming closer and closer. In the network, both the number of talents and the choices of overseas routines are mounting. The network development has obvious small-world characteristics. However, the two levels of network differentiation are significant, and the difference is decreasing year by year. Second, the rank-size distributions of network nodes weighted degree of accession and weighted degree of output conform to the law of power distribution, showing a typical "pyramid structure" characteristics, reflecting that the global talent mobility network is controlled by a small number of pivotal node countries. The spatial patterns of the global talent mobility network are basically "from east to west, and from south to north", but the trend of mobile regionalization is gradually emerging, and the role of emerging countries attracting talents has gradually increased. Thirdly, the core-periphery structure of the global talent mobility network is remarkable. The countries in the core, strong semi-periphery and semi-periphery alternate with countries from other tiers. There is a strong mobility of relations between the core countries. The marginal countries are not connected with each other, or have weak links with each other. The talent of the marginal countries mainly flows to the core countries and semi-marginal countries. Finally, the global talent mobility network community has been significantly differentiated. The network has evolved into six associations, including American associations, EU associations, Chinese associations, South American and South African associations, Malaysian associations, and CIS associations. The scale of associations varies widely. Like the overall network, each community has a similar "pyramid structure" feature.

[本文引用: 3]

DOI:10.11821/dlxb201808006 [本文引用: 1]

On the basis of patent transaction data in 2015, spatial pattern of interurban technology transfer network in China was portrayed by integrating big data mining, social network, and GIS, from the perspectives of nodal strength and centrality, linkage intensity, and modular divisions. Then, its key influencing factors were identified as well using the Negative Binominal Regression Analysis. Some findings were ontained as follows. First of all, the intensity of interurban technology transfers in China is not well distributed with obvious polarization. Those cities with higher-level technology transfers are concentrated in the three urban clusters, namely, the Yangtze River Delta, the Pearl River Delta and Beijing-Tianjin-Hebei urban agglomeration. Secondly, a typical core-periphery structure with hub-and-spoke organization is evidently observed, which consists of several hubs and the majority of cities with far lower technology transfers. Beijing, Shenzhen, Shanghai and Guangzhou are acting as the pivot of the technology transfer network and playing a critical role in aggregating and dispersing technology flows. Thirdly, technology linkage intensities of urban pairs appear to be significantly uneven with hierarchies, centralizing in the three edges from Beijing to Shanghai, from Shanghai to Guangzhou and Shenzhen, and from Beijing to Guangzhou and Shenzhen, which shapes a triangle pattern. Fourthly, the technology transfer network is divided into four communities or plates, with prominent reflexivity and spillover effects, which is resulted from geographical proximity and technological complementary. Last but not least, spatial flows of technology are co-organized by a variety of spatial diffusion modes such as hierarchical diffusion, contact diffusion and leapfrog diffusion, owing to economic and administrative powers. They are greatly influenced by urban economic scale, foreign linkage, policy making, as well as multiple proximity factors related to geographical, technological, social and industrial proximities.

[本文引用: 1]

DOI:10.11821/dlxb201912005 [本文引用: 1]

Transportation connection has always been one of the important perspectives of studying spatial cascading systems and urban systems. Based on the timetable data in 2018 of inter-city coach, high-speed train and aviation, this paper builds networks of the three modes of transportation in China. Through the methods of the city-pair connectivity and community detection, this paper compares the spatial structure and linkage systems of multi-traffic flow network and reveals the geospatial constraints. The research results show that: (1) Different modes of transportation are suitable for portraying urban systems on different spatial and administrative scales. Inter-city coaches are constrained by the provincial administrative boundaries. High-speed train network shows the effect of corridors especially along the main trunks. The aviation network reflects the spatial relationship at the national scale. (2) From the perspective of the direct accessibility, there is a large spatial overlap between inter-city coaches and high-speed trains, and the market of inter-city coaches is obviously squeezed in recent years. For air transport, its frequency advantage mainly concentrates on the city-pairs with a long distance. The competition and complementarity of the three modes of transportation have a great impact on the urban system and are useful for the understanding of the spatial cascading system. (3) Geographical space, infrastructure space and administrative space constraint and management system are important factors affecting the transportation networks. Inter-city coach network and high-speed train network are obviously affected by distance attenuation effects, and they present significant community structures in the two networks, but their communities have different spatial characteristics. However, air transport does not follow the constraint of distance attenuation, and there is not an obvious community structure in the network. Factors related to the passenger transport market, such as social and economic links and tourism resources, play the important roles in the aviation network structure.

[本文引用: 1]

[本文引用: 1]

[本文引用: 1]

DOI:10.1111/tesg.12141URL [本文引用: 1]

[本文引用: 3]

[本文引用: 3]

[本文引用: 1]

[本文引用: 1]

DOI:10.11821/dlxb201704014 [本文引用: 1]

Despite increasing importance of academic papers in global knowledge flows, the structural disparities and proximity mechanism related to international scientific collaboration network attracted little attention. To fill this gap, based on data mining from Thomson Reuters' Web of Science database in 2014, its heterogeneities in topology and space were portrayed using visualizing tools such as Pajek, Gephi, VOSviewer, and ArcGIS. Topologically, 211 countries and 9928 ties are involved in global scientific collaboration network, but the international network of co-authored relations is mono-centricand dominated by the United States. It exhibits some features of a "small-world" network with the smaller average path length of 1.56 and the extremely large cluster coefficient of 0.73 compared to its counterpart, as well as the better-fitting exponential distribution accumulative nodal degree. In addition, the entire network presents a core-periphery structure with hierarchies, which is composed of 13 core countries and the periphery of 198 countries. Spatially, densely-tied and high-output areas are mainly distributed in four regions: West Europe, North America, East Asia and Australia. Moreover, the spatial heterogeneity is also observed in the distributions of three centralities. Amongst these, the countries with greater strength centrality are mainly concentrated in North America (i.e. the US and Canada), Western Europe (i.e. the UK, France, Germany, Italy and Spain), and China, noticeably in the US, which forms the polarizing pattern with one superpower of the US and great powers such as China and the UK. Similarly, the big three regions consisting of West Europe, North America and Asian-Pacific region have the peak betweenness centrality as well. Slightly different from the two above, the distribution of nodal degree centrality is uneven in the world, although regional agglomeration of high-degree countries is still observed. Last but not least, the proximity factors of its structural inequalities were also verified by correlational analysis, negative binomial regression approach and gravity model of STATA. The findings further confirm that geographical distance has weakened cross-country scientific collaboration. Meanwhile, socio-economic proximity has a positive impact on cross-country scientific collaboration, while language proximity plays a negative role.

[本文引用: 1]

[本文引用: 1]

[本文引用: 1]

DOI:10.18306/dlkxjz.2019.02.004 [本文引用: 2]

After the Second World War, financial globalization, an important component of economic internationalization, has become a key characteristic of the global economic development. Offshore financial centers are developed under the background of financial internationalization and innovation, and play an important role in promoting development and change of capital organization and emerging markets. Because of their unique geographical distribution and important role in the global economy and financial system, geographers have begun to study offshore financial centers. In this article, we reviewed the literature on offshore financial centers in geography. We first introduced the related concepts and changes, then examined the following topics: the location and development conditions of offshore financial centers, their regional and global influences, the interaction between offshore financial centers and the global financial system, and their development in China. Moreover, we discussed how to research offshore financial centers from a geographical perspective in the future.

[本文引用: 2]

DOI:10.13249/j.cnki.sgs.2018.11.003 [本文引用: 1]

At present, China’s city innovation system is gradually taking shape. As the core component of innovation resources, innovative technology represented by patents has become the focus of competition among all cities. Its gathering and diffusion channels urgently need to build a compatible city technology transfer system. The construction of a national technology transfer system in line with the law of science and technology innovation, the law of technology transfer and the law of industrial development is an inevitable choice for serving the strategy of innovation development. Based on data mining from National Intellectual Property Office of China, the heterogeneities and its evolution characteristics of city innovation network depicted by patent transfer in topology and space from 2001 to 2015 were sketched using lots of visualizing tools such as Pajek, Gephi, VOSviewer, ArcGIS, and so on. Topologically, from 2001 to 2015, with the increasing number of cities involved in technology transfer, China city innovation network has emerged a significant small-world feature with the smaller average path length and the extremely large cluster coefficient compared to its counterpart. In addition, the entire network presents a core- periphery structure with hierarchies, which dominated by Beijing, Shanghai and Shenzhen. Spatially, the quadrilateral pattern of China city innovation network based on the triangular structure is gradually formed. Last but not least, the growth mechanism of city innovation network were also verified by correlational analysis, negative binomial regression approach and gravity model of STATA. The growth of city innovation network in China is significantly related to the technological innovation strength represented by the number of patent application. The findings further confirm that geographical distance has weakened cross-city patents transfer. Meanwhile, the similarity of economic development and industrial structure between cities are also important factors influencing the growth of city innovation network.

[本文引用: 1]

[本文引用: 1]

DOI:10.1111/gpol.2010.2.issue-1URL [本文引用: 1]

[本文引用: 1]