, 王洋

, 王洋 , 蔺雪芹

, 蔺雪芹Spatial differentiation patterns and influencing mechanism of housing prices in China: Based on data of 2872 counties

WANGShaojian , WANGYang

, WANGYang , LINXueqin

, LINXueqin通讯作者:

收稿日期:2015-12-9

修回日期:2016-03-6

网络出版日期:2016-08-25

版权声明:2016《地理学报》编辑部本文是开放获取期刊文献,在以下情况下可以自由使用:学术研究、学术交流、科研教学等,但不允许用于商业目的.

基金资助:

作者简介:

-->

展开

摘要

关键词:

Abstract

Keywords:

-->0

PDF (4433KB)元数据多维度评价相关文章收藏文章

本文引用格式导出EndNoteRisBibtex收藏本文-->

1 引言

国家或区域内部的住宅价格往往存在显著的空间差异现象[1-3],并成为人文地理学和区域经济学研究的重要议题。中国自1998年住房制度改革以来,住宅价格迅速上涨,年均增长达7%[4]。在这种背景下,中国区域或城市间住宅价格的空间差异现象也逐渐显著[5-7]。房价水平最高的北京西城区,其住宅均价已是大兴安岭呼中区的67.73倍(2014年5月),并逐步显现出区域房地产市场分化的新格局和新趋势[8]。住宅价格存在的巨大空间差异已经影响到中国城市化移民的定居决策[9],成为影响区域劳动力流动的重要因素和门槛。当前对中国住宅价格区域差异的研究主要关注省际差异[4]和城市间差异[3]。其中,省际差异的分析以31个省份为基本单元[10];城市间差异的研究主要以35个大中城市[11-12]、30个省会城市[13]或287个地级市[3]为样本。对更细致的县级单元房价差异问题关注不多。事实上,已有研究表明,对分析单元的细化可得出更多的信息和更精确的结论[14]。县是中国行政管理的基层单元,数量多,差异大,因此,以县域为基本单元对中国住宅价格的格局、因素和机制的研究可能得出更精确的观点。国家内部住宅价格差异必然有其多元化的影响因素。供需理论框架是最常用的分析视角[15]。在需求方面,收入和人口统计变量是两个重要影响因素[16];收入影响到住房购买力,进而决定住房需求[17]。人口增长会相应地增加住宅需求,进而影响住宅价格[18]。另外,城市的经济结构会影响到城市的收入、人口、失业率、空置率等指标,进而通过影响需求关系影响到住宅价格[19]。在住房供给方面,土地供应和住房建设成本等指标可直接影响住房供给,并影响住宅价格[20-21]。住房的供给弹性会受到购房者担负能力的限制[22],而购房担负能力与购房者的收入水平密切相关。另外,工资也在某种程度上决定住房的建设成本,进而也影响供给。在供需框架的基础上,住房市场环境对住宅价格影响不容忽视[23-24]。研究表明房地产市场的买卖交易摩擦[25]、成交额[26]和从业人员数[27]是决定住宅价格的重要因素。因此,可将住房市场环境因素作为供需分析框架的补充,建立住房“需求+供给+市场”的三维理论分析框架,综合分析区域或城市间住宅价格的差异因素。在国家内部,不同等级、不同类型区域的住房市场特征往往存在较大差异,但已有研究往往仅分析总体影响因素,对不同区域存在的差别化影响因素关注不足。因此,应更加关注区域住房价格影响因素的地域差异性特征,并分析其差异的原因。

对中国住宅价格空间差异影响因素的研究认为:移民和城市化对中国省际房价差异有重要影响[28];收入水平、建设成本、即将到来的婚姻、使用者成本和土地价格是中国29个省的房价差异的核心影响因素[29];经济结构和城市家庭状况(人均收入、人口、失业率、空置率)能够解释中国14个城市住宅价格差异[19];中国21个省会城市的地价与房价具有相互的内生关系[30];户籍人口、工资收入、城市土地供给、建筑成本可解释中国主要城市间的住宅价格差异[31];收入、贷款利率、人均居住面积、非农人口数、成本、城市化水平、城市建成区面积等因素对中国35个大中城市住宅均衡价格存在显著影 响[32];人均GDP、非农人口数、商品住宅销售面积对中国35个城市住宅价格差异的影响最为显著[33]。这些研究的结论各异,是由于其理论视角、样本选择、指标选取、数据时间各有不同造成的。已有研究表明,供需理论对中国住宅价格差异的解释能力更强[3]。因此,可以供需理论为核心分析视角,采用更为细致的县级单元数据,剖析中国住宅价格差异的影响机制。区域住宅价格差异的影响因素复杂且多元,直接影响因素和间接作用因素并存,宜选择能够对住房需求、供给、市场直接影响的几个核心因素,这对细致剖析中国住宅价格差异的影响机制具有重要意义。另外,中国区域差异显著[34],不同地区、不同行政等级单元的住房子市场特征可能不同。可分别剖析区域住房子市场内部的因素差异性特征,为差异化制定住宅价格调控策略和房地产市场发展政策提供依据。

本文以中国2872个县(县级市、区)为基本研究单元,分析2014年中国住宅价格的空间差异格局与特征,探讨空间关联性和集聚规律。在此基础上,基于“需求+供给+市场”的三维理论视角,分析住宅价格差异的影响因素和作用强度,并剖析不同行政等级地域的影响因素差异性特征和机制。其中,研究对象几乎包含了所有县级行政单元,样本深度更进一步;房价是基于大量实际挂牌数据得出的,更具现实性;选取的影响因素指标与住房的供需和市场环境直接相关;因素分析注重地域差异性,避免全国“一刀切”的结论。这在样本深度、数据支撑和影响因素方面均有新的进展,可为该领域提供最新的实证研究参考,具有重要的学术意义。

2 数据与研究方法

2.1 研究区域和数据来源

以中国2872个县级行政单位为基本研究单元(含区、县级市、旗、自治旗、林区、特区),不包括港澳台。住宅价格数据来源于3个方面(图1):① 源于禧泰数据公司建设的全国城市房地产数据库(简称“禧泰数据”)。该数据库是目前中国最大的网络房地产交易数据库(http://www.cityre.cn/cityCenter.html),覆盖了118个主要地级城市的947个县级单元,房屋数据量达到了1.133亿套。该数据的采集时段为2014年5月,住房单价由该数据库对当月各住房出售数据自动算出;② 源于“好屋房价”的网络数据平台(http://jia.haowu123.com/),该数据库的二手住房数据达到6221万套,相比于“禧泰数据”,“好屋房价”数据库覆盖的县域范围更多。因此,除了“禧泰数据”以外的719个县域房价数据来源于“好屋房价”,采集时段依然为2014年5月;③ 源于对“58同城”网站(http:/*.58.com/)中二手房出售平台的人工数据挖掘。“58同城”的二手房出售数据平台已经成为当前中国最主要的房地产信息平台之一,其数据地域覆盖范围最广,几乎可覆盖中国所有的县域单元。因此,除了“禧泰数据”和“好屋房价”不能覆盖的县域,都以“58同城”为数据来源。对其数据挖掘的方法是以2014年6月为基准,以各县级单元的最新500条二手房出售单价的平均值为该县域的平均房价,少于500条信息的,采用2014年的全部数据计算平均值。该方法计算的价格数据也基本可以真实反映该地区的平均房价,覆盖的县域单元共1094个。另外,还有112个县域单元(主要分布在青藏高原)的房地产交易数据极少,不能合理计算出该地区的房价,本次研究按无数据处理。 显示原图|下载原图ZIP|生成PPT

显示原图|下载原图ZIP|生成PPT图13种不同房价数据来源的空间分布

-->Fig. 1The spatial distribution of 3 kinds of housing prices data sources in China

-->

从3种数据来源的分布特征看,“禧泰数据”覆盖了沿海城市群和内陆主要的城市密集区,占县域数量的32.97%;“好屋房价”数据覆盖了各省的次级重要区域,占全国的25.03%;其余地区为“58同城”挖掘数据覆盖的区域,占到38.09%;无住房数据区域集中在西藏、青海、四川西部、甘肃南部,占总数的3.90%。3种数据挖掘方法体现出房价挂牌数据量由多到少、获取由易到难、房地产市场由活跃到不活跃的变化特征。这些住宅价格数据以房地产三级市场(二手房交易)的挂牌价为主。相比于国家统计局或当地房管部门的统计数据,更能真实地反映当地住宅价格的实际情况。这是由于国家统计局公布的是房价指数(以同类小区相近住房为样本,基于实际销售价格统计得出);而当地房管部门公布的数据是该地区当月住房网签后的加权平均数,容易受到成交量结构性变化和“阴阳合同”的影响。因此,基于大样本数据得出的二手房挂牌价更具有稳定性和代表性。

分别选择2010年各县级单元的租房户比重、城镇流动人口数量、城镇在岗职工平均工资、房地产从业人口比重、土地平均出让价格作为中国住宅价格差异的影响因素数据,基于各县级单元城镇在岗职工平均工资和人均住房面积作为房价收入比的计算数据。这些数据主要来源于《中国2010人口普查分县资料》、《2011中国城市统计年鉴》、《2011中国国土资源统计年鉴》、《2011中国区域经济统计年鉴》、《2011中国县(市)社会经济统计年鉴》。选择2010年为因素数据的原因是该年份进行了第六次全国人口普查,数据较为全面。另外,Zhang[35]研究表明,中国住房需求、住房购买能力、土地价格因素对住宅价格的影响往往有3年左右的滞后性,因此影响因素数据的采集时段定为2010年年末较为合理可行。

2.2 研究方法

2.2.1 通过空间自相关分析住宅价格的空间关联性与集聚特征 区域住宅价格呈现出显著的空间关联与空间相关性[36-37]。全局自相关指数(GMI)和局部自相关指数(LMI)可以定量测度住宅价格的空间关联程度与空间格局。GMI可判定住宅价格的全局空间自相关程度,表示为[38-39]:式中:xi为第i个县域的住宅价格;Wij是各县域的空间权重矩阵,县域之间的距离在设定的门槛距离内,为1,大于该距离则为0。

在住宅价格全局自相关的基础上,往往容易出现县域间的局部自相关现象,因此,利用LMI对局部自相关进行测度,LMI可表示为:

式中:

2.2.2 采用核密度函数估计住宅价格的总体分布特征 核密度方法的优点是,避免了预先指定某个特定分布形态(例如正态分布)而造成的误差[40]。这种方法可从住房价格自身的特点来获取分布形态信息。假定中国县域住宅价格的密度函数为f(x),核密度估计函数为fn(x),那么在某县域住宅价格x上的核密度估计表达式为[41]:

式中:

2.2.3 基于住宅价格模型和地理探测器探索住宅价格差异的影响因素及其作用强度 多元线性回归模型是住宅价格模型中常见的形式之一,该模型中各因素的显著性水平可作为相应其是否是主要影响因素的判断标准[42]。其表达式为:

式中:F1、F2、…、Fn为影响住宅价格的各因素;a1、a2、…、an为各住宅价格影响因素的回归系数;P是住宅价格;a0为截距。

若同时出现多个对住宅价格差异有显著影响的因素,可借助地理探测器进一步定量判断各因素对住宅价格差异的作用强度。地理探测器由Wang等[43]****于2010年建立,并首先应用于地方性疾病风险和相关地理影响因素的研究。地理探测器模型的优点在于假设方面受到的制约较少[44]。借助该方法探讨影响因素强度的核心思想是:影响住宅价格变化的相关因素在空间上具有差异性,若某因素和住宅价格的强度在空间上具有显著的一致性,则说明这种因素对住宅价格的形成具有决定意义。影响因素的地理探测力值可表示为[43]:

式中:PD,U为房价探测因子D的探测力值;m为次级区域的个数;n为一级区域内县域的个数;nD,i为次级区域内县域的个数;σ2U为一级区域住宅价格的方差;σ2UD,i为次级区域住宅价格的方差;PD,U取值区间为[0, 1],PD,U值越大,U因素对住宅价格的影响程度越高。

3 中国住宅价格的空间差异格局与特征

3.1 住宅价格的总体空间差异格局特征

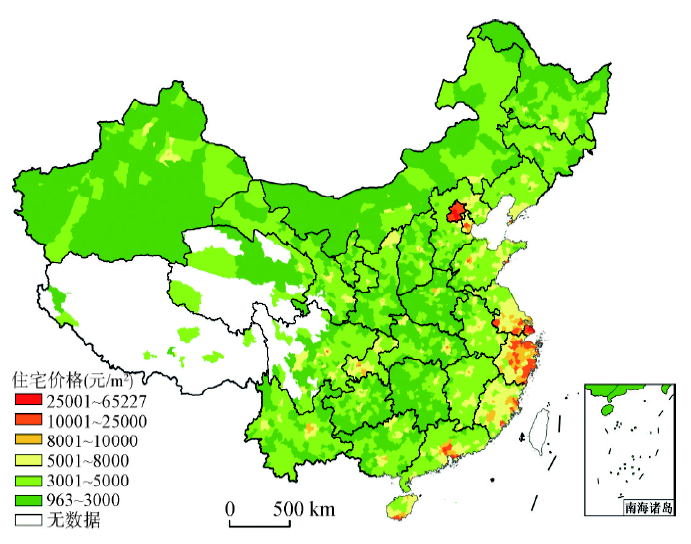

将2014年中国各县级单元的房价进行聚类分析,同时兼顾取整数原则,将房价由低到高的阈值确定为3000元/m2、5000元/m2、8000元/m2、10000元/m2、25000元/m2共6个等级。住宅价格低于3000元/m2为定义低房价区域(791个);3001~5000元/m2为中低房价区域(1250个);5001~8000元/m2为中等房价区域(464个);8001~10000元/m2为中高房价区域(109个);10001~25000元/m2高房价区域(115个);高于25000元/m2为极高房价区(31个)。根据上述分级绘制成中国住宅价格差异格局图(图2)。结果显示中国住宅价格格局呈现以行政等级差异为主、空间集聚差异为辅的双重差异特征。行政等级差异在各省份内部表现较为显著:区域行政等级越高,房价越高,总体上呈现出“省会城市市区—地级市市区—县(县级市)”的住宅价格差异格局;空间集聚差异表现在高房价区集中在以长三角、珠三角、海峡西岸为代表的东南沿海三大城市群和京津地区,中低房价区分布在内陆地区。 显示原图|下载原图ZIP|生成PPT

显示原图|下载原图ZIP|生成PPT图22014年中国住宅价格的空间差异特征与格局

-->Fig. 2The spatial differentiation and spatial pattern of housing prices in China in 2014

-->

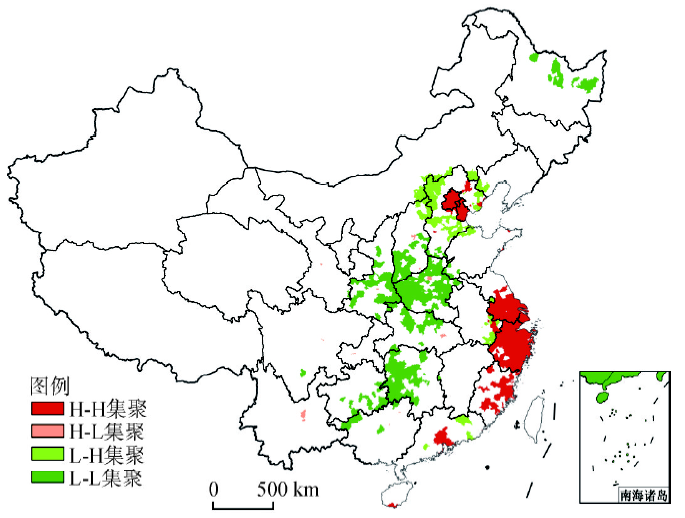

根据Moran's I指数进一步分析中国住宅价格的空间关联与集聚特征。采用FD法作为空间权重矩阵的判断依据,门槛距离设置为300 km,计算出Moran's I指数为0.3538,Z统计值为115.7776,表明中国住宅价格总体上呈显著的空间集聚特征。在此基础上,根据LMI判断住宅价格的局部空间自相关特征(图3)。图中表明住宅价格的H-H区全部在沿海省份,集聚分布在京津地区、上海—苏南—浙江地区、福建部分地区和广深地区;H-L区分布在内陆省份的省会城市,以点状分布为主,表明内陆省份的省会城市是该省房地产市场的核心,住宅价格呈现单极极化的特征;L-H区主要分布在京津地区周边的“环首都经济圈”,这些地区尽管毗邻京津地区,但与京津地区的住宅价格差距巨大,形成价格洼地;L-L区集中连片分布在中西部省份:一是河南—山西—陕西—湖北交界地区,二是湖南西部—贵州东南部,三是黑龙江东北部地区。

显示原图|下载原图ZIP|生成PPT

显示原图|下载原图ZIP|生成PPT图32014年中国住宅价格的LMI散点地图

-->Fig. 3Scatter maps of Local Moran's I (LMI) of housing prices in China, 2014

-->

3.2 住宅价格的等级性分布特征

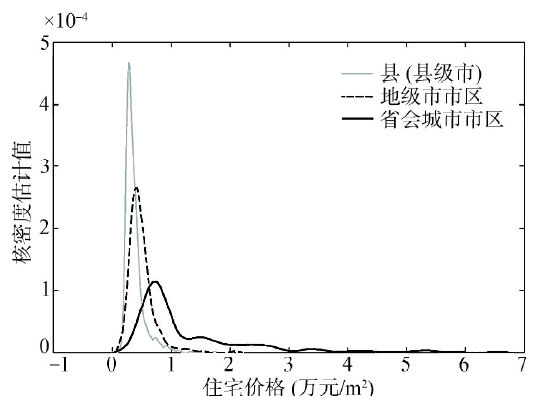

3.2.1 不同等级行政单元的核密度分布特征 分别分析省会城市市区(含直辖市、副省级市)、地级市市区(含地区、州、自治州政府所在地县市)、县(县级市)3个行政等级单元的住宅价格分布特征(图4)。图中表明行政等级越高的区域,价格分布的区间越大,分布形态越“扁平”,内部价格的绝对差距和差异越显著;而行政等级越低的区域,分布形态“越高耸”。不同等级区域最高核密度区间的分布特征表明,总体上,省会城市市区住宅价格最高,地级市市区其次,县的价格最低。另外,每个等级区域核密度曲线的右侧都有一个明显的“长尾”,表明各等级区域内部都存在着少数房价较高的行政单元,也显示出高房价区与中低房价区域之间是房价差异的主要方向。行政等级越高的区域子市场,“长尾”越长,表明行政等级越高的区域,高房价区的数量越多,内部价格差异越大。 显示原图|下载原图ZIP|生成PPT

显示原图|下载原图ZIP|生成PPT图42014年中国住宅价格的核密度分布

-->Fig. 4The kernel density estimate of housing prices in China in 2014

-->

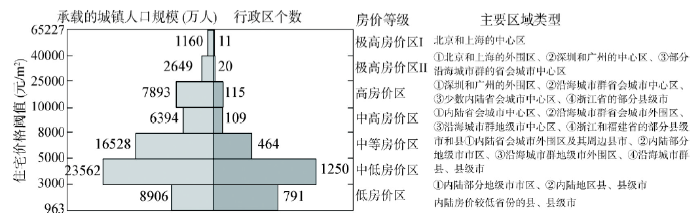

3.2.2 中国“住宅价格等级金字塔”的分布特征 根据本文确定的住宅价格等级阈值,计算每个价格等级内部的县域行政区个数及其所在区域的城镇人口规模,绘制成中国“住宅价格等级金字塔”,并探索各房价区段内的区域类型(图5)。图中表明,除了低房价区外,总体呈现房价越高,区域越少,所居住的城镇人口越少的“金字塔式”等级分布,房价呈现出高等级城市高于低等级城镇、沿海城市群高于内陆区域、中心区高于外围区的特征。住宅价格大于10000元/m2的高房价区域共146个,所居住人口为1.17亿人,占全国城镇人口的17.44%。而住宅价格低于5000元/m2的区域多达2041个,占全国县域(有房价数据)的73.95%,居住的城镇人口为4亿人,占全国城镇人口的59.75%。由此可见,无论是区域范围还是人口数量方面,中国的高房价问题是局部性问题而不是全国性问题。但高房价县市往往是区域的政治、经济、文化中心,也是外来人口的主要集聚区,因此高房价问题的社会影响力不可忽视。

显示原图|下载原图ZIP|生成PPT

显示原图|下载原图ZIP|生成PPT图52014年中国“住宅价格等级分布金字塔”

-->Fig. 5The pyramid shape of distribution of housing prices in China in 2014

-->

4 中国住宅价格差异的主要影响因素及作用强度差异

4.1 中国住宅价格空间差异的主要影响因素

以住房“需求+供给+市场”的三维理论视角作为分析中国住宅价格差异影响因素的切入点。其中,分别以租房户比例、流动人口规模、住房支付能力表征住房的需求程度和购买力,以住房市场活跃度表示市场因素的作用,以土地成本代表住房供给和建设成本底限。这些因素分别以租房户数占总户数的比重、城镇流动人口数量、城镇在岗职工平均工资、房地产业就业人口比重、土地平均出让价格5个指标代表(表1)。具体而言,租房户以外来人口为主,一般在该城市(县)无住房,并且有购房的刚性需求,同时,租房户比重越高,其住房购买的困难程度也越大,房价一般也越高;流动人口是反映住房综合性需求和城市综合吸引力的重要指标,这些人融入城市的意愿普遍较强,对住房产生的刚性或潜在性需求巨大,人口净流入较大的城市,其房价往往也较高;城镇在岗职工平均工资可同时体现该区域对房价的购买力和承受能力,影响住房的需求,同时影响住房供给的弹性;房地产市场活跃度可直接反映该地区住房投资需求和房地产市场的成熟程度;土地价格是影响住房供给的核心因素,也在很大程度上决定了住房成本。由于数据的限制,本文的土地价格以县级单元所在地级单元的土地价格表示。Tab. 1

表1

表1中国住宅价格差异的影响因素

Tab. 1The impact factors of differentiation of housing prices in China

| 影响因素 | 代表性指标(单位) | 对住宅价格的影响路径 | 预期影响 | 指标计算过程与数据来源 |

|---|---|---|---|---|

| F1 租房户比例 | 租房户数占总户数的比重(%) | 住房刚性需求和购房困难程度 | 正向 | “六普”调查的租房户数除以总户数 |

| F2 流动人口规模 | 城镇流动人口数量 (人) | 住房的综合性需求 | 正向 | “六普”常住人口口径的城镇人口减去户籍人口口径非农人口 |

| F3 住房支付能力 | 城镇在岗职工平均工资(元) | 住房购买力和房价承受力、住房供给弹性 | 正向 | 国家统计部门统计的职工平均工资 |

| F4 住房市场活跃度 | 房地产业就业人口比重(%) | 房地产市场成熟程度、住房投资需求 | 正向 | “六普”调查的房地产业从业人员数除以16岁以上各行业从业人员总数 |

| F5 土地成本 | 土地平均出让价格 (万元/hm2) | 住房供给 | 正向 | 国土部门发布的土地出让收益除以土地出让面积 |

新窗口打开

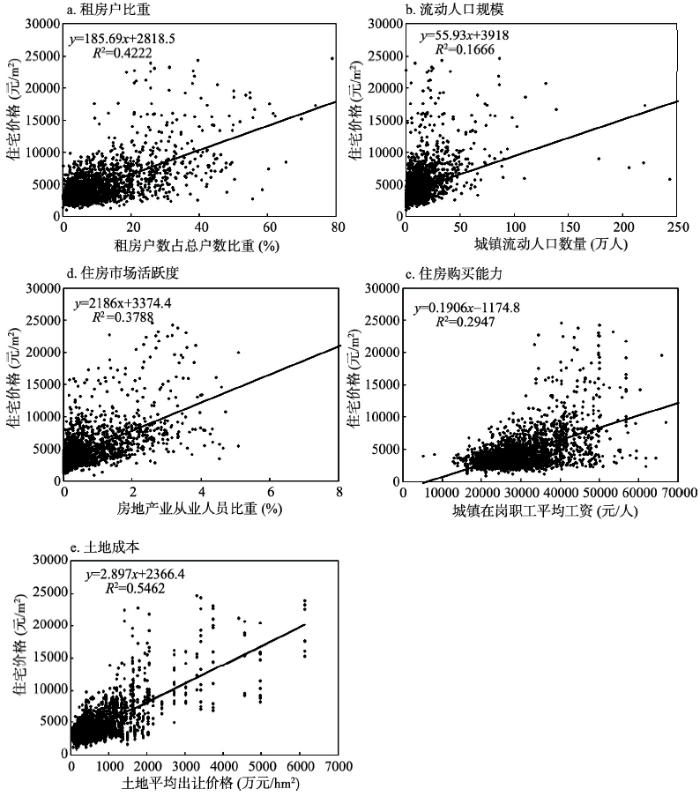

生成5大影响因素与住宅价格之间的散点图(图6),以便进一步探索各因素影响房价的程度及其影响方向(不分析价格高于25000元/m2的少数极高房价区域)。图中表明,5大因素与住宅价格之间均呈现正相关,并且每个单因素对住宅价格差异的代表性程度也较高,进一步验证了这5个影响因素选取的合理性。其中,土地成本、租房户比例和住房市场活跃度3项因素的R2较高,表明这3项因素对房价差异具有较高的代表程度。限于数据收集的限制,各县域的平均土地出让价格这一指标以地级单元的数据替代。由于中国土地价格往往体现为大区域范围的城市间差异[45],因此地级单元间的差异更为显著[46],因此,该指标数据处理方式对结论的影响不大。

显示原图|下载原图ZIP|生成PPT

显示原图|下载原图ZIP|生成PPT图62014年中国住宅价格差异因素与房价之间关系的散点图

-->Fig. 6The scatter diagrams of relationship between impact factor and housing prices in China in 2014

-->

各因素间存在相互作用,对住宅价格往往具有共同的影响。因此,在上述5个影响因素的共同作用下,县级单元的住宅价格就是这5个影响因素的函数,基于该住宅价格回归模型验证各因素对房价的影响方向与程度(表2)。通过模型回归得出拟合优度R为0.855,调整R2为0.731,df值为5,模型的总体拟合非常好,5大影响因素对房价的代表程度很高,且远高于各单因素的影响程度,再次表明中国住宅价格差异是由多因素共同作用的结果。F值为1502.289,显著性水平0.000,说明回归模型极其显著。回归标准系数表明,这5个因素显著性水平远远小于0.01,表明这些因素对县域间住宅价格差异的影响都非常显著,并且都与住宅价格正相关,该结果与预期判断完全一致。

Tab. 2

表2

表22014年中国住宅价格模型的回归系数

Tab. 2The regression coefficient of housing prices model in China in 2014

| 影响因素 | 非标准化系数 | 标准误差 | 标准化系数 | t值 | 显著性水平 | 模型的相关参数 |

|---|---|---|---|---|---|---|

| 待定系数 (α0) | -1103.623 | 178.337 | - | -6.188 | 0.000 | R = 0.855 |

| F1 租房户比例 | 28.680 | 6.657 | 0.065 | 4.308 | 0.000 | R2 = 0.732 |

| F2 流动人口规模 | 0.001 | 0.000 | 0.033 | 2.882 | 0.007 | 调整R2= 0.731 |

| F3 住房支付能力 | 0.089 | 0.007 | 0.178 | 12.947 | 0.000 | F = 1502.289 |

| F4 住房市场活跃度 | 1448.468 | 72.222 | 0.281 | 20.056 | 0.000 | Sig.= 0.000 |

| F5 土地成本 | 2.702 | 0.068 | 0.488 | 39.482 | 0.000 | df = 5 |

新窗口打开

根据非标准化系数和截距构建中国县域住宅价格的回归模型为:

该模型说明,在其他因素不变的情况下,租房户比例每提高1%,房价将增加28.680元;流动人口每增加1人,房价将上升0.001元;职工年平均工资每增加1元,房价将提升0.089元;房地产业就业人口比重每增加1%,房价将提高1448.468元;平均土地出让价格每增加1元,房价将相应增加2.702元。

租房户比例表征了住房非自有程度。中国拥有住房(购买途径)的观念非常强烈,租房被认为是解决居住问题的过渡方案,租房户是住房刚性需求的最大人群。因此,当一个城市租房户比重越多时,表明该城市住房供需矛盾越大、购房困难程度高。例如,黄浦区(上海市的中心城区)租房户比例达66.82%,其房价高达45172元/m2,而河北省鹿邑县的租房户比例仅为0.01%,其房价也仅为2709元/m2。

流动人口规模与住宅价格显著正相关。流动人口在区域劳动力市场中扮演着重要角色,并且是区域吸引力的重要体现。年轻人口往往更倾向于流动,从而为人口流入地带来了大量的住房刚性需求。东部和中部地区的人口流入格局与住房价格格局基本一致即是该因素作用的体现。

基于工资水平的住房支付能力是表征该地区购房者对房价承受能力的重要标尺,也是房价能否持续上涨的基础,从而决定住房的有效需求。区域工资水平是吸引力劳动进入的重要因素,并决定了区域竞争力。如果没有竞争力的工资,区域劳动力供给将逐渐减少,进而降低住房的需求[47]。中国区域间存在着巨大的工资差异,北京、上海主城区的年平均工资在80000元/人以上,但还有184个县市的年平均工资在20000元/人以下。工资差异也是中国区域间发展不平衡的重要体现,并通过供需机制反馈到住房价格差异中。

住房市场活跃度可直接反映该地区住房投资需求和房地产市场的成熟程度,对房价有正向影响作用。这主要表现为房地产市场的买卖交易摩擦会对住宅价格产生影响[25],其市场成交额也与住宅价格正相关[26]。城市行政等级越高,其房地产市场活跃程度越大,这与住宅价格的差异特征吻合。例如上海是中国房地产市场最活跃的城市之一,上海的长宁区、静安区、普陀区、卢湾区的房地产业从业人员比重都高于5%,这4个区的住宅价格分别高达41820元/m2、52220元/m2、32878元/m2、48640元/m2,是中国住宅价格最高的区域之一。而中国有978个县(县级市)(主要分布在内陆地区)的房地产业从业人员比重在0.1%以下,而这些地区的房地产市场活跃程度很低,这978个县市的住房平均价格仅为3145元/m2。

土地价格是决定住宅价格的重要因素和基础。住宅建设的第一步是开发商需要通过招标、拍卖、挂牌等形式取得国有土地使用权。这一过程中的土地取得成本成为住宅价格的基础和底线。相关研究表明,中国城市土地价格占商品房售价的比重由1998年的9.0%上升到2011年的24.3%,土地成本差异已成为住宅成本差异的重要因素,中国土地价格变动也是住宅价格变动的Granger原因[48]。根据Wheaton建立的“四象限模型”可知[47],土地价格的提升将使土地供应量的下降,在容积率不变的前提下,住房的供应量将下降;在需求不变的前提下,住宅价格将提升。因此,从住房供给的角度看,土地成本与住宅价格正相关。

4.2 各影响因素对中国住宅价格差异的作用强度差异

通过地理探测器进一步分析各因素对中国住宅价格差异作用强度的差异性。根据中国县域住房价格“金字塔”式的分布特征,将5大因素的代表性指标值分别由高到低分为5级:高(10%)、中高(20%)、中等(40%)、中低(20%)和低(10%)水平区,根据该比例确定探测因子次级区域划分的阈值,并利用GIS绘制成图(图7)。 显示原图|下载原图ZIP|生成PPT

显示原图|下载原图ZIP|生成PPT图72014年中国住宅价格的地理探测因子类别化空间分布

-->Fig. 7Spatial distribution of classified potential determinants for housing prices in China in 2014

-->

由于不同行政等级城市(县)在城区规模、人口吸引力、城市发展阶段、房地产市场发育程度、土地市场状况等方面存在着较大的差异。行政等级越高的城市,人口吸引力越大,土地越稀缺,其住房供需矛盾越大,房地产市场越活跃[3,8]。因此,各影响因素对不同行政等级城市的作用强度必然存在差异性。因此,基于地理探测器分别分析省会城市市区、地级市市区、县(县级市)各自的影响因素作用强度差异(表3)。结果表明,在全国层面,各探测因子的探测力值差异较大。其中,土地成本的影响(0.3837)最为显著,租房户比例(0.3291)和住房市场活跃度(0.3214)的影响也较高,而流动人口规模的探测力值最弱。按行政等级划分的3种住房子市场内部影响因子探测力值远大于全国层面,再次表明中国存在着按行政等级划分的住房子市场。不同行政等级子市场内部的影响因素强度各有不同:省会城市市区中,住房市场活跃度、租房户比例、土地成本这3项因素的影响最为显著;地级市市区中,住房支付能力为最显著的影响因素,而流动人口规模的影响非常弱;县和县级市中,住房支付能力的影响最弱,其余4个因素都有一定程度的影响。

Tab. 3

表3

表32014年中国住宅价格的5大影响因素的地理探测结果

Tab. 3Detected result of potential determinants of housing prices in China in 2014

| 租房户比例 | 流动人口规模 | 住房支付能力 | 住房市场活跃度 | 土地成本 | |

|---|---|---|---|---|---|

| 全国 | 0.3291 | 0.1664 | 0.2816 | 0.3214 | 0.3837 |

| 省会城市市区 | 0.9069 | 0.6452 | 0.8307 | 0.9244 | 0.9070 |

| 地级市市区 | 0.8790 | 0.0095 | 0.9108 | 0.8166 | 0.7141 |

| 县和县级市 | 0.7844 | 0.7382 | 0.2829 | 0.7489 | 0.7022 |

新窗口打开

5 结论

(1)中国住宅价格格局呈现以行政等级性为主、空间集聚性为辅的双重差异特征,其空间关联与集聚特征显著;行政等级越高的区域,价格分布的区间越大,子市场内部的绝对差距和差异越显著,高房价区的数量也越多。(2)中国住宅价格呈现出房价越高,区域越少,所居住城镇人口越少的“金字塔式”等级分布,且高等级城市高于低等级城镇、沿海城市群高于内陆地区、中心区高于外围区。

(3)基于“需求+供给+市场”理论视角的分析表明,租房户比例、流动人口规模、住房支付能力、住房市场活跃度、土地成本是中国住宅价格差异的5个重要影响因素。其中,土地成本、租房户比例和住房市场活跃度在全国层面的影响最为显著,不同行政等级子市场的影响因素强度各异。在省会城市市区,住房市场活跃度、租房户比例、土地成本的影响最为显著;在地级市市区,住房支付能力为最显著的影响因素;县和县级市中,住房支付能力的影响最弱,其余4个因素都有一定程度的影响。

本文采用地理探测器探索了5大因素对房价的作用强度差异,未来可采用地理加权回归等方法进一步比较验证。另外,这5大直接因素的形成与变动可能受到优质公共资源、产业发展水平、城区建设水平、地形与气候条件等区域基本特征的作用与影响,这些区域发展要素是住宅价格形成与变动的内在源动力。因此,未来还应关注上述内在源动力对直接影响因素的作用路径与机制。

The authors have declared that no competing interests exist.

参考文献 原文顺序

文献年度倒序

文中引用次数倒序

被引期刊影响因子

| [1] | . Existing literature on housing prices is predominantly in a linear framework, and an important question that has not been addressed is whether housing prices exhibit nonlinearity. We examine Smooth Transition Autoregressive (STAR) model based nonlinear properties of housing prices over the 1969-2004 period for the entire US and the four regions. Our main findings are (1) housing price for the entire US and all regions except for the Midwest show non-linearity, (2) the dynamic properties implied by the nonlinear estimation explain the typical patterns that have characterized each housing market, and (3) results of Granger causality tests look more plausible in the nonlinear framework where we find stronger evidence of Granger causality from housing price to employment and also from mortgage rates to housing price. |

| [2] | . KUETHE T.H. and PEDE V.O. Regional housing price cycles: a spatio-temporal analysis using US state-level data, Regional Studies. A study is presented of the effects of macroeconomic shocks on housing prices in the Western United States using quarterly state-level data from 1988:1 to 2007:4. The study contributes to the existing literature by explicitly incorporating locational spillovers through a spatial econometric adaptation of vector autoregression (SpVAR). The results suggest these spillovers may Granger cause housing price movements in a large number of cases. SpVAR provides additional insights through impulse response functions that demonstrate the effects of macroeconomic events in different neighbouring locations. In addition, it is demonstrated that including spatial information leads to significantly lower mean-square forecast errors. |

| [3] | . <p>分别研究2009 年中国286 个地级以上城市住宅均价和房价收入比的空间分异格局、总体趋势、空间异质性和相关性;根据供需理论和城市特征价格理论建立了影响中国城市住宅价格空间分异的初选因素,并根据半对数模型分析主要影响因素。结果表明:① 中国城市住宅价格空间分异显著,呈现出空间集聚性分异(东南沿海三大城市群与内陆城市之间)和行政等级性分异(省会与地级市之间)的双重格局;② 房价收入比较高的城市数量更多,分布范围更广,购房难度较大的城市已超过一半;③ 住宅均价的总体分异趋势和空间异质性都强于房价收入比;④ 城市居民收入与财富水平和城市区位与行政等级特征是住宅价格空间分异的两大核心影响因素。</p> . <p>分别研究2009 年中国286 个地级以上城市住宅均价和房价收入比的空间分异格局、总体趋势、空间异质性和相关性;根据供需理论和城市特征价格理论建立了影响中国城市住宅价格空间分异的初选因素,并根据半对数模型分析主要影响因素。结果表明:① 中国城市住宅价格空间分异显著,呈现出空间集聚性分异(东南沿海三大城市群与内陆城市之间)和行政等级性分异(省会与地级市之间)的双重格局;② 房价收入比较高的城市数量更多,分布范围更广,购房难度较大的城市已超过一半;③ 住宅均价的总体分异趋势和空间异质性都强于房价收入比;④ 城市居民收入与财富水平和城市区位与行政等级特征是住宅价格空间分异的两大核心影响因素。</p> |

| [4] | . The soaring housing prices in many provinces of China have recently attracted increasing attention. This study addresses the questions of whether there are housing price bubbles in the provinces and whether the bubbles are spatially contagious. We adopt a unit root, cointegration test that uses structural changes and loan-to-income ratios to test housing rational bubbles and a vector error correction model (VECM), the Impulse Response Function, and Granger causality to investigate potential contagion and spillover effects from core to peripheral provinces. Housing price data from 28 provinces in China, ranging from the first quarter of 2000 to the fourth quarter of 2012, are analyzed. First, it is found that most of the provinces do have bubbles and affordability problems. Second, housing prices in provinces that were within the same potentially contagious region were cointegrated together. Third, spillover effects existed in contagious regions around Beijing and Shanghai, where each province has severe bubbles and affordability problems. |

| [5] | . 从城市环境特征角度研究中国房地产价格的区间差异,在Roback理论模型基础上提出了估计中国城市消费者和厂商环境特征品质价值的计量方法,并对我国所有地级及以上城市进行了截面分析.消费者环境特征品质方程估计结果显示:自然环境对我国居民效用水平的影响类似于其对美国居民的影响,工业污染严重地损害了居民的福利水平,但是,公共服务水平对我国居民效用水平的影响并不显著.厂商生产性环境特征品质方程的估计结果则表明,城市间交通条件、工业集聚以及生产性服务都对厂商有显著的价值. . 从城市环境特征角度研究中国房地产价格的区间差异,在Roback理论模型基础上提出了估计中国城市消费者和厂商环境特征品质价值的计量方法,并对我国所有地级及以上城市进行了截面分析.消费者环境特征品质方程估计结果显示:自然环境对我国居民效用水平的影响类似于其对美国居民的影响,工业污染严重地损害了居民的福利水平,但是,公共服务水平对我国居民效用水平的影响并不显著.厂商生产性环境特征品质方程的估计结果则表明,城市间交通条件、工业集聚以及生产性服务都对厂商有显著的价值. |

| [6] | . 通过对1998-2009年年间、国家发改委所监测的国内35个大中城市房屋销售价格指数面板数据,进行单位根和Granger因果检验,表明中国城市居民的住房价格在经济地位最重要的城市之间存在波动的传递。表现出:一,在传递的水平方向上具有地理方向性;二,在传递的垂直方向上具有"4-4-9-9-9"的层级结构性。研究认为中国城市房价的波动是一个地理扩散过程,并且具有邻里扩散与等级扩散相并存的特征。这与国外相关文献的研究成果基本一致。房价的地理扩散属于"发展的地理扩散",具有区域外部性的性质,可以从一个侧面揭示区域外部性传递的过程和形成的格局。 . 通过对1998-2009年年间、国家发改委所监测的国内35个大中城市房屋销售价格指数面板数据,进行单位根和Granger因果检验,表明中国城市居民的住房价格在经济地位最重要的城市之间存在波动的传递。表现出:一,在传递的水平方向上具有地理方向性;二,在传递的垂直方向上具有"4-4-9-9-9"的层级结构性。研究认为中国城市房价的波动是一个地理扩散过程,并且具有邻里扩散与等级扩散相并存的特征。这与国外相关文献的研究成果基本一致。房价的地理扩散属于"发展的地理扩散",具有区域外部性的性质,可以从一个侧面揭示区域外部性传递的过程和形成的格局。 |

| [7] | . This paper introduces the house searching model with down-payment constraints and analyzes the price–volume relationships in Chinese coastal and inland housing markets. With the panel data from 35 Chinese metropolitans, the Granger relationship (from price change to trading volume) is found in coastal cities where house prices are high with speculation. But under the rigorous policy of purchase limit, such price–volume linkage is somewhat dampened. By contrast, in inland cities where speculative activity is relatively weak, the Granger causality (from volume to price change) is more significant before the prohibition policy. After that, the effects reverse. However, in both kinds of cities the impulse responses remain significant, indicating that the driving mechanisms between price and volume may occur because of exogenous impulses. The results suggest that strict market intervention causes some significant effects but cannot radically change the driving mechanism. |

| [8] | . 研究目的:分析中国城市住房价格空间分化的新趋势、新格局与新特征,并定量探索土地市场因素对其分化的作用机制。研究方法:PDI分化指数分析、GIS空间分析、灰色关联分析。研究结果:中国城市住宅价格存在显著的空间分化现象,分化的主方向是一线城市与其他城市的等级性分化;住宅价格的空间差异格局呈现出行政等级性差异增强,空间集聚性分异减弱的新格局与新特征;土地市场包括的土地供给和土地成本因素同时决定了中国城市间住宅价格的空间分化,其中土地供给对三线城市的的影响更为显著;土地市场对不同等级城市的影响程度各异,整体来看,对一线城市房价增长的驱动最为明显。研究结论:2009年以来中国城市住宅价格的空间分化显著增强,并与土地市场因素密切相关,土地供给是核心影响因素。 . 研究目的:分析中国城市住房价格空间分化的新趋势、新格局与新特征,并定量探索土地市场因素对其分化的作用机制。研究方法:PDI分化指数分析、GIS空间分析、灰色关联分析。研究结果:中国城市住宅价格存在显著的空间分化现象,分化的主方向是一线城市与其他城市的等级性分化;住宅价格的空间差异格局呈现出行政等级性差异增强,空间集聚性分异减弱的新格局与新特征;土地市场包括的土地供给和土地成本因素同时决定了中国城市间住宅价格的空间分化,其中土地供给对三线城市的的影响更为显著;土地市场对不同等级城市的影响程度各异,整体来看,对一线城市房价增长的驱动最为明显。研究结论:2009年以来中国城市住宅价格的空间分化显著增强,并与土地市场因素密切相关,土地供给是核心影响因素。 |

| [9] | . Rural rban migrants are the major group who will boost the transformation of China's urbanization and reform of the household registration system. Their aspirations of living in the immigration area are an important premise of institutional change. The housing prices within the immigration areas are an important factor that can influence the rural rban migrants' settlement decision. To what degree does the housing price influence the settlement decision? Do regional differences exist in the influence of house price? These issues need to be analyzed and verified in a theoretical and empirical ways. By introducing the variables of the housing price into the life-cycle theory function, we found that housing price influences the settlement decision through the welfare dissipation effect and the expected wealth effect. On the basis of welfare dissipation effect, hypothesis 1, we can come to the conclusion that high housing price will play a negative role in the process of settlement decision formation. Through expected wealth effect, hypothesis 2, we estimate that a housing price rise will promote the aspiration of living in the immigration area to some extent inversely. On this hypothesis basis, using the panel data model of China's 31 provinces and cities for the period 1995-2012, we found that, at the national level, the influence of housing price to the settlement decision is not significant. From the view of regional differences, the influence is negative in the eastern area, indicating that the welfare dissipation effect is greater than the expected wealth effect, in line with the hypothesis 1. The increase of housing prices will promote the settlement decision in the central area, this phenomena explains that the expected wealth effect is greater than the welfare dissipation effect, in line with the hypothesis 2. In the western area, the influence is non-significant. |

| [10] | . 运用加权变异系数衡量了我国地区住房价格差异程度,应用灰色关联度筛选解释影响我国地区住房 价格差异的变量,并以2007年地区横截面数据为依据,采用偏最小二乘回归分析方法,建立了对所选变量的偏最小二乘回归模型。结果表 明,1998~2007年,我国住房价格地区差异较大,用偏最小二乘回归方法提取的成分具有线性无关的特点,对我国地区住房价格差异有较好的解释能力,同 时可以消除输入因素的多重共线性。在解释我国地区住房价格差异的变量中,居民收入对我国地区住房价格差异贡献最大,地区经济发展水平次之,住房竣工面积与 我国地区住房价格差异水平呈负相关。 . 运用加权变异系数衡量了我国地区住房价格差异程度,应用灰色关联度筛选解释影响我国地区住房 价格差异的变量,并以2007年地区横截面数据为依据,采用偏最小二乘回归分析方法,建立了对所选变量的偏最小二乘回归模型。结果表 明,1998~2007年,我国住房价格地区差异较大,用偏最小二乘回归方法提取的成分具有线性无关的特点,对我国地区住房价格差异有较好的解释能力,同 时可以消除输入因素的多重共线性。在解释我国地区住房价格差异的变量中,居民收入对我国地区住房价格差异贡献最大,地区经济发展水平次之,住房竣工面积与 我国地区住房价格差异水平呈负相关。 |

| [11] | . 本书试图解释中国住宅价格与土地价格的城市间差异, 评价当前土地城市微观干预预政策的效果, 并提出相应的政策建议。 . 本书试图解释中国住宅价格与土地价格的城市间差异, 评价当前土地城市微观干预预政策的效果, 并提出相应的政策建议。 |

| [12] | . 在中国,劳动力在城市间流动性的逐渐增强使得居民能够自由选择居 住城市,这种居民在城市间的重分布促使房价被重估,更准确地反映居民对于城市价值(包括城市经济发展质量和城市生活质量)的支付意愿.本文对中国35个大 中城市的实证研究表明,在我国城市住宅市场中,城市价值已经被很显著地资本化到房价当中.城市居民的劳动收入水平越高,或者城市生活质量越好,城市的房价 就会越高.这意味着,人们愿意为居住在一个城市所支付的成本(即房价),取决于他们能够在这个城市里获得怎样的经济收入和发展机会,以及享受怎样的生活质 量.本研究还发现,在早期,城市生活质量要素在房价中是被低估的,向合理水平的收敛过程会带来房价的上升.同时,收入要素对房价的贡献度在下降,而城市生 活质量要素对房价的贡献明显上升,表明居民在选择城市时更加重视城市的自然环境和城市政府提供的公共服务的质量. . 在中国,劳动力在城市间流动性的逐渐增强使得居民能够自由选择居 住城市,这种居民在城市间的重分布促使房价被重估,更准确地反映居民对于城市价值(包括城市经济发展质量和城市生活质量)的支付意愿.本文对中国35个大 中城市的实证研究表明,在我国城市住宅市场中,城市价值已经被很显著地资本化到房价当中.城市居民的劳动收入水平越高,或者城市生活质量越好,城市的房价 就会越高.这意味着,人们愿意为居住在一个城市所支付的成本(即房价),取决于他们能够在这个城市里获得怎样的经济收入和发展机会,以及享受怎样的生活质 量.本研究还发现,在早期,城市生活质量要素在房价中是被低估的,向合理水平的收敛过程会带来房价的上升.同时,收入要素对房价的贡献度在下降,而城市生 活质量要素对房价的贡献明显上升,表明居民在选择城市时更加重视城市的自然环境和城市政府提供的公共服务的质量. |

| [13] | |

| [14] | . |

| [15] | . The purpose of this paper is to identify the sources of intercity house price differentials in Canada. The results indicate that demand factors are important explanatory variables; a 1% increase in the income of households raises house prices by 1.11%; higher rates of anticipated inflation result in higher house prices as households increase their demand for real assets such as housing during inflationary periods; and finally, the fraction of households that are non-family households is positively associated with house prices. These results are in agreement with those of other countries. Copyright American Real Estate and Urban Economics Association. |

| [16] | . |

| [17] | . In this paper we model the dynamic adjustment of real house prices using data at the level of US States. We consider interactions between housing markets by examining the extent to which real house prices at the State level are driven by fundamentals such as real income, as well as by common shocks, and determine the speed of adjustment of house prices to macroeconomic and local disturbances. We take explicit account of both cross sectional dependence and heterogeneity. This allows us to find a cointegrating relationship between house prices and incomes and to identify a small role for real interest rates. Using this model we examine the role of spatial factors, in particular the effect of contiguous states by use of a weighting matrix. We are able to identify a significant spatial effect, even after controlling for State specific real incomes, and allowing for a number of unobserved common factors. |

| [18] | . |

| [19] | . Using the Panel Data of housing prices and economic fundamentals of 14 cities for 1995—2002, with the Pooled Least Squares and Dummy Variable Regression Model, this paper investigates the city-level interactions of housing prices and economic fundamentals in China. It reveals that, during all the period, past and current information of economic fundamentals could partially explain the level or percentage change rate of housing prices and the city-level housing market in China is not in accordance with the Efficient Market Hypothesis. Special effects of cities do exist in the reduced form composed by the level of the variables, and special effects of years are significant in 1998 and later on, especially for 2001—2002. The growth of housing prices could not be well explained by past information of economic fundaments and housing prices in recent years which may need the policy makers and practitioners pay enough attention to. |

| [20] | . In this paper we examine long-run house price convergence across US states using a novel econometric approach advocated by Pesaran (2007) arid Pesaran et al. (2009). Our empirical modelling strategy employs a probabilistic test statistic for convergence based on the percentage of unit root rejections among all state house price differentials. Using a sieve bootstrap procedure, we construct confidence intervals and find evidence in favour of convergence. We also conclude that speed of adjustment towards long-run equilibrium is inversely related to distance. (C) 2011 Elsevier B.V. All rights reserved. |

| [21] | . We combine the real estate model of Potepan (1996) with the spatial equilibrium approach of Roback (1982) to prove the interdependency of housing prices, rental prices, building land prices and income via one simultaneous equilibrium analysis. Using unique cross-sectional data on the majority of German counties and cities for 2005, we estimate the equations in their structural and reduced form. The results show significantly positive interaction effects of income and real estate prices. Moreover, we can confirm model predictions concerning the majority of exogenous determinants. In particular, expectations about population development seem to be among the most important determinants of price and income disparities between regions in the long term. (C) 2011 Elsevier Inc. All rights reserved. |

| [22] | . This article compares the level and distribution of the welfare changes from restricting land available for residential development in a city. We compare the economic costs when residential capital is durable with the costs when capital is perfectly malleable and those when population is also freely mobile. Our simulation, based on the stylized specification of an urban location model, suggests that in a more realistic setting with durable capital, the costs of regulation are substantially higher than they are when capital is assumed to be malleable or when households are assumed to be fully mobile. Importantly, the extent of wealth redistribution attributable to these regulations is much larger when these more realistic factors are recognized. When capital is durable, the results also imply that far more new development takes place on previously undeveloped land at the urban boundary, sometimes resulting in an increase in total land under development. |

| [23] | |

| [24] | . |

| [25] | |

| [26] | . ABSTRACT This Paper presents a dynamic theory of housing market fluctuations. It develops a life-cycle model where households are heterogeneous with respect to income and preferences, and mortgage lending is restricted by a down-payment requirement. The market interaction of young credit-constrained households with older or richer unconstrained households generates the following results. (1) Current income of young credit-constrained households affects housing prices independently of aggregate income. (2) Housing prices and the number of housing transactions are positively correlated. (3) Housing prices over-react to income shocks. (4) A relaxation of the down-payment constraint triggers a boom-bust cycle. These results are consistent with patterns observed in the US and the UK. |

| [27] | . CiteSeerX - Scientific documents that cite the following paper: Economic fundamentals in local housing markets: Evidence from u.s. metropolitan regions |

| [28] | . This paper explores the possible effects of rural-urban migration and urbanization on China's urban housing prices through focusing on a critical decade in urban housing reform, from 1995 to 2005. Compared with other countries, China differs, to a certain extent, in migration and urbanization patterns due to its unique Household Registration System (Hukou) and huge population base. However, very few empirical housing studies have examined the role of rapid urbanization and massive rural-urban migration in affecting housing price dynamics in China. This paper analyses the changes over time in housing prices in each Chinese province and examines empirically the determinants of urban house price at national and regional levels using time-series and cross-sectional data. The study finds that the abolition of the policy on the provision of welfare housing in 1998 is an important milestone in Chinese urban housing reform, which resulted in the market-oriented urban housing provision system. When comparing the results from coastal and inland provincial analyses, it is found that coastal provinces encountered greater pressure and challenges in dealing with the accommodation of migrants who were mainly from inland provinces. In contrast, inland provinces have relatively less pressure from migrants. The results from this paper are also in agreement with the hypothesis that regional variations in the urbanization level would have impact on the price of sold commodity houses. The results from this microlevel analysis of housing price may inform the Chinese policy makers to re-evaluate China's urban housing reform policies from the perspective of facilitating labor migration and urbanization. (C) 2010 Elsevier Ltd. All rights reserved. |

| [29] | . The barley (Hordeum vulgare) cultivar Golden Promise is no longer widely used for malting, but is amenable to transformation and is therefore a valuable experimental cultivar. Its characteristics include high salt tolerance, however it is also susceptible to several fungal pathogens. Proteome analysis was used to describe the water-soluble protein fraction of Golden Promise seeds in comparison with the modern malting cultivar Barke. Using 2D-gel electrophoresis to visualise several hundred proteins in the pH ranges 4-7 and 6-11, 16 protein spots were found to differ between the two cultivars. Eleven of these were identified by mass spectrometric peptide mass mapping, including an abundant chitinase implicated in defence against fungal pathogens and a small heat-shock protein. To enable a comparison with transgenic seed protein patterns, differences in spot patterns between field and greenhouse-grown seeds were analysed. Four spots were observed to be increased in intensity in the proteome of greenhouse-grown seeds, three of which may be related to nitrogen availability during grain filling and total protein content of the seeds, since they also increased in field grown seeds supplied with extra nitrogen. Finally, the fate of transgene products in barley seeds was followed. Spots containing two green fluorescent protein constructs and the herbicide resistance marker phosphinothricin acetyltransferase were observed in 2D-gel patterns of transgenic seeds and identified by mass spectrometry. Phosphinothricin acetyltransferase was observed in three spots differing in pI suggesting that post-translational modification of the transgene product had occurred. |

| [30] | . Economic fundamentals are recognized as determining factors for housing and land prices on the city level, but the relationship between housing price and land price has been disputed. In this paper, a simultaneous-equations model is developed to explore the interaction between housing price and land price. This model uses urban land price and housing price as endogenous variables and five factors for land price and seven factors for housing price as exogenous variables. By using sample data of 21 provincial cities in China from 2000 to 2005, the model is estimated by using the two-stage least-squares method. Housing price and land price have an endogenous interrelationship, and as a whole, housing price has greater influence on land price. Per capita disposable income is not only an important factor for land price but also has a direct impact on housing price. Lagged house price has the highest degree of influence on housing price, which implies that increased house price is the expected effect of housing price. The model is effective and reasonable, and it can provide a basis for relevant government departments to establish related policies. |

| [31] | . This paper seeks to understand the importance of changes in the fundamental factors of demand and supply, such as the urban hukou population, wage income, urban land supply, and construction costs, in explaining the rising residential housing prices in major Chinese cities between 2002 and 2008. We propose an empirical approach that uses both city-level and residential development project-level data. Results suggest that, for most of the cities in our sample, changes in fundamental factors can account for a major proportion of the actual housing price appreciation. However, in several coastal cities, the actual increase in housing prices deviates largely from what can be predicted from fundamental changes. |

| [32] | . 依据供求关系原理和住宅价格变化特征模型,探讨住宅均衡价格的形成机制与住宅实际价格的变化机理。利用我国35个大中城市2000,2004年的经济统计指标和住宅市场数据,识别出住宅均衡价格;并将实际价格变化分解成均衡价格变化、实际价格的均值回复和趋势性运动等三个组成部分,重点研究住宅实际价格与均衡价格之间的关系。研究表明:我国住宅市场存在由供求基础决定的均衡价格,城镇家庭人均可支配收入、个人住房抵押贷款利率水平、城镇人均居住面积、非农人口数等需求因素,以及供给成本、城市化水平和城市建成区面积等供给因素对住宅均衡价格存在显著影响;住宅实际价格的变化受到均衡价格变化的显著影响;住宅实际价格可通过自我调整回复到均衡价格水平,并存在缓慢上涨的趋势。 . 依据供求关系原理和住宅价格变化特征模型,探讨住宅均衡价格的形成机制与住宅实际价格的变化机理。利用我国35个大中城市2000,2004年的经济统计指标和住宅市场数据,识别出住宅均衡价格;并将实际价格变化分解成均衡价格变化、实际价格的均值回复和趋势性运动等三个组成部分,重点研究住宅实际价格与均衡价格之间的关系。研究表明:我国住宅市场存在由供求基础决定的均衡价格,城镇家庭人均可支配收入、个人住房抵押贷款利率水平、城镇人均居住面积、非农人口数等需求因素,以及供给成本、城市化水平和城市建成区面积等供给因素对住宅均衡价格存在显著影响;住宅实际价格的变化受到均衡价格变化的显著影响;住宅实际价格可通过自我调整回复到均衡价格水平,并存在缓慢上涨的趋势。 |

| [33] | . 从供给和需求的角度出发,选择我国35个大中城市1999—2007年的住宅相关数据构建了其需求和供给模型,得出各变量对住宅价格的影响关系,并运用逐步回归法确定了每个大中城市住宅价格的主要影响因素,进而揭示了35个大中城市商品住宅价格主要影响因素的空间分布,并据此对35个大中城市进行了分类。 . 从供给和需求的角度出发,选择我国35个大中城市1999—2007年的住宅相关数据构建了其需求和供给模型,得出各变量对住宅价格的影响关系,并运用逐步回归法确定了每个大中城市住宅价格的主要影响因素,进而揭示了35个大中城市商品住宅价格主要影响因素的空间分布,并据此对35个大中城市进行了分类。 |

| [34] | . Regional inequality is a core issue in geography, and it can be measured by several approaches and indexes. However, the global inequality measures can not reflect regional characteristics in terms of spatiality and non-mobility, as well as correctly explore regional inequality in particular directions. Although conventional between-group inequality indexes can measure the inequality in particular directions, they can not reflect the reversals of regional patterns and changes of within-group patterns. Therefore, we set forth a new approach to measure regional inequality in particular directions, which is applicable to geographic field. Based on grouping, we established a new index to measure regional inequality in particular directions named Particular Direction Inequality index (PDI index), which is comprised of between-group inequality of all data and between-group average gap. It can reflect regional spatiality and non-mobility, judge the main direction of regional inequality, and capture the changes and reversals of regional patterns. We used the PDI index to measure the changes of regional inequality from 1952 to 2009 in China. The results show that: 1) the main direction of China's regional inequality was between coastal areas and inland areas; the increasing extent of inequality between coastal areas and inland areas was higher than the global inequality; 2) the PDI index can measure the between-region average gap, and is more sensitive to evolution of within-region patterns; 3) the inequality between the northern China and the southern China has been decreasing from 1952 to 2009 and was reversed in 1994 and 1995. |

| [35] | . Since 2005, the Chinese government has frequently strengthened controls on the real estate market. Land supply policy was included in the system of state macro-control on the real estate market and state economic development. This paper examines the following issues after analyzing the panel data of Yunnan Province and other provinces of China. (1) Does land supply have significant effects on the real estate market after more than ten years of urban land reforms? (2) Which land supply policy affected the real estate market in China? (3) Does it affect the real estate market and macro-economic control of China's existing land supply policy? The main conclusions of the paper are: (1) Land supply policy has a significant impact on the real estate market with the deepening of China's urban land system reform and the development of the land market. (2) China's land supply policy, as a powerful macro-control tool, has an impact on the real estate market under the government's monopoly. (3) The effects of the land tenure and use reform can mainly be seen in the land supply quota and the extent to which the market-driven supply effects the real estate market. |

| [36] | . |

| [37] | . In this paper we model the dynamic adjustment of real house prices using data at the level of US States. We consider interactions between housing markets by examining the extent to which real house prices at the State level are driven by fundamentals such as real income, as well as by common shocks, and determine the speed of adjustment of house prices to macroeconomic and local disturbances. We take explicit account of both cross sectional dependence and heterogeneity. This allows us to find a cointegrating relationship between house prices and incomes and to identify a small role for real interest rates. Using this model we examine the role of spatial factors, in particular the effect of contiguous states by use of a weighting matrix. We are able to identify a significant spatial effect, even after controlling for State specific real incomes, and allowing for a number of unobserved common factors. |

| [38] | . ABSTRACT Statistical data are ”spatial” when they are compiled according to a topographical classification or simply consist of a pattern of points, or are otherwise associated with maps or locations. The authors’ earlier ”Spatial autocorrelation.” Academic Press (1973) addressed hypothesis testing for the correlation and trend in a spatially-observed variable. The new book is enlarged to cover extensive recent work on models and analysis of spatial patterns. Compared to B. D. Ripley’s book ”Spatial statistics.” (1981; Zbl 0583.62087)] the present book contains more evaluation of the statistical performance of proposed methods upon case studies (mainly demographic), and less exposition of mathematical aspects of model-building or image analysis. Features are the discussions of scale and of model identification, caveats on the use of statistical methods based on independence, and analysis of regression residuals. Correlograms (but not spectral analysis) are prominent. The book is addressed to a mixed audience and supplies 258 references. |

| [39] | . The capabilities for visualization, rapid data retrieval, and manipulation in geographic information systems (GIS) have created the need for new techniques of exploratory data analysis that focus on the “spatial” aspects of the data. The identification of local patterns of spatial association is an important concern in this respect. In this paper, I outline a new general class of local indicators of spatial association (LISA) and show how they allow for the decomposition of global indicators, such as Moran's I, into the contribution of each observation. The LISA statistics serve two purposes. On one hand, they may be interpreted as indicators of local pockets of nonstationarity, or hot spots, similar to the G i and G* i statistics of Getis and Ord (1992). On the other hand, they may be used to assess the influence of individual locations on the magnitude of the global statistic and to identify “outliers,” as in Anselin's Moran scatterplot (1993a). An initial evaluation of the properties of a LISA statistic is carried out for the local Moran, which is applied in a study of the spatial pattern of conflict for African countries and in a number of Monte Carlo simulations. |

| [40] | . 居民收入密度函数的核密度估计 具有非连续性,因无法通过积分计算特定收入区间的人口规模,故在核密度估计基础上,构建二分递归算法用以测算特定收入群体规模。使用中国健康和营养调查中 的中国农村居民人均纯收入的微观调查数据,对中国农村居民收入分布进行核密度估计,并通过二分递归算法测算中国农村贫困发生率,结果显示:考虑到微观数据 源和数据内容上的一些差异,计算得到的农村贫困发生率符合国家统计局公布的变动趋势且数值差异不大。因此,在核密度估计下使用二分递归算法计算特定收入群 体规模具有有效性。 . 居民收入密度函数的核密度估计 具有非连续性,因无法通过积分计算特定收入区间的人口规模,故在核密度估计基础上,构建二分递归算法用以测算特定收入群体规模。使用中国健康和营养调查中 的中国农村居民人均纯收入的微观调查数据,对中国农村居民收入分布进行核密度估计,并通过二分递归算法测算中国农村贫困发生率,结果显示:考虑到微观数据 源和数据内容上的一些差异,计算得到的农村贫困发生率符合国家统计局公布的变动趋势且数值差异不大。因此,在核密度估计下使用二分递归算法计算特定收入群 体规模具有有效性。 |

| [41] | . 以2001-2012 年扬州中心城区各居住小区的住宅平均单价为基本数据,通过建立住宅价格总体分异测度指数(GDI) 计算其总体分异趋势及各住宅类型内部的分异趋势;采用核密度函数等方法探索住宅价格的分布形态和分异格局的演变规律;利用趋势面分析不同住宅类型价格的空间分异趋势;基于上述结果总结空间分异的演变模式,并分别探索空间分异与格局演变的驱动力。结果表明:① 2001 年以来扬州市住宅价格差距显著增大,分异趋势在波动中增强,与城市住宅均价的年增长率耦合;住宅价格呈现西高东低的空间分异格局,同档次价格小区由空间集聚转为相对分散,高、低价格住宅区分别沿固定扇面由中心向外围扩散。②不同住宅类型内的价格分异走势差别显著,各类型住宅间的价格趋势面差距明显,但其空间形态类似。③ 空间分异模式由2001 年西高东低的扇形同档次价格集聚式分异转变为2012 年扇形与圈层相结合的多档次价格混合式分异。④ 2001 年以来住宅价格总体分异的核心驱动力是城市居住空间的迅速扩展、居民收入差距的增大、房地产市场的繁荣和住宅类型的多元化,其住宅价格空间格局演变的驱动力为城市发展方向的确立与变化、特定住宅类型建设的区位指向和古城保护、旧城改造与新区建设。 . 以2001-2012 年扬州中心城区各居住小区的住宅平均单价为基本数据,通过建立住宅价格总体分异测度指数(GDI) 计算其总体分异趋势及各住宅类型内部的分异趋势;采用核密度函数等方法探索住宅价格的分布形态和分异格局的演变规律;利用趋势面分析不同住宅类型价格的空间分异趋势;基于上述结果总结空间分异的演变模式,并分别探索空间分异与格局演变的驱动力。结果表明:① 2001 年以来扬州市住宅价格差距显著增大,分异趋势在波动中增强,与城市住宅均价的年增长率耦合;住宅价格呈现西高东低的空间分异格局,同档次价格小区由空间集聚转为相对分散,高、低价格住宅区分别沿固定扇面由中心向外围扩散。②不同住宅类型内的价格分异走势差别显著,各类型住宅间的价格趋势面差距明显,但其空间形态类似。③ 空间分异模式由2001 年西高东低的扇形同档次价格集聚式分异转变为2012 年扇形与圈层相结合的多档次价格混合式分异。④ 2001 年以来住宅价格总体分异的核心驱动力是城市居住空间的迅速扩展、居民收入差距的增大、房地产市场的繁荣和住宅类型的多元化,其住宅价格空间格局演变的驱动力为城市发展方向的确立与变化、特定住宅类型建设的区位指向和古城保护、旧城改造与新区建设。 |

| [42] | . 构建包含20个评价因子、4 个影响因素和4 个预期修正因素在内的城市住宅价格空间分异影响因素评价体系,基于评价因子和预期修正,分别得出单户住宅档次与水平、小区建设档次与水平、区位与生活便利性、周边景观与环境等4 个影响因素强度的得分,并分析其空间分异格局。以2012 年扬州市1305 个小区的平均住宅单价为因变量,4 个基本影响因素得分为自变量,进行回归分析,探索所有住宅及各子市场价格分异的主要因素,并分析其驱动机制。结果表明:① 4 个影响因素强度格局明显不同,住宅自身因素的格局呈现中心低外围高的圈层式分异,而外部作用因素强度呈现中心高外围低、西高东低的扇型与圈层相结合式空间分异格局;② 扬州市总体住宅价格空间分异的核心影响因素是小区建设档次与水平,不同类型住宅子市场的价格影响因素各不相同;③ 扬州市住宅价格空间分异的主要驱动力是特定住宅类型与档次建设的区位指向、特定收入阶层的空间集聚、公共物品投资的空间差异、城市居住用地扩展与城市更新的区位指向。 . 构建包含20个评价因子、4 个影响因素和4 个预期修正因素在内的城市住宅价格空间分异影响因素评价体系,基于评价因子和预期修正,分别得出单户住宅档次与水平、小区建设档次与水平、区位与生活便利性、周边景观与环境等4 个影响因素强度的得分,并分析其空间分异格局。以2012 年扬州市1305 个小区的平均住宅单价为因变量,4 个基本影响因素得分为自变量,进行回归分析,探索所有住宅及各子市场价格分异的主要因素,并分析其驱动机制。结果表明:① 4 个影响因素强度格局明显不同,住宅自身因素的格局呈现中心低外围高的圈层式分异,而外部作用因素强度呈现中心高外围低、西高东低的扇型与圈层相结合式空间分异格局;② 扬州市总体住宅价格空间分异的核心影响因素是小区建设档次与水平,不同类型住宅子市场的价格影响因素各不相同;③ 扬州市住宅价格空间分异的主要驱动力是特定住宅类型与档次建设的区位指向、特定收入阶层的空间集聚、公共物品投资的空间差异、城市居住用地扩展与城市更新的区位指向。 |

| [43] | . Physical environment, man-made pollution, nutrition and their mutual interactions can be major causes of human diseases. These disease determinants have distinct spatial distributions across geographical units, so that their adequate study involves the investigation of the associated geographical strata. We propose four geographical detectors based on spatial variation analysis of the geographical strata to assess the environmental risks of health: the risk detector indicates where the risk areas are; the factor detector identifies factors that are responsible for the risk; the ecological detector discl |

| [44] | . heterogeneity; injuries; error |

| [45] | . 城市地价的影响因素众多且复杂,地价水平和地价变化趋势受到社会、经济、政策等多方面因素的共同影响。论文从城市土地供需和宏观政策角度选取房地产投资额、市辖区建设用地面积、耕地占用税等10 项影响因素,采用2008-2010 年全国105 个土地市场较发育城市分季度地价数据,建立地价水平值与地价增长率影响因素的多层线性模型,定量分析了不同行政层次下,各影响因素对城市土地价格和地价增长率的影响程度。研究结论显示,地价水平值与地价增长率的影响因素不尽相同,且主导因素差异显著:在市级地价影响因素中,房地产投资增长是地价上升的直接动力,而地价增长率则主要受城市建设用地面积、房地产投资额的影响较;省级耕地保护政策对平抑地价、控制地价涨速作用显著,其中新增建设用地土地有偿使用费和耕地占用税是省级层次影响最显著的两项政策指标。 . 城市地价的影响因素众多且复杂,地价水平和地价变化趋势受到社会、经济、政策等多方面因素的共同影响。论文从城市土地供需和宏观政策角度选取房地产投资额、市辖区建设用地面积、耕地占用税等10 项影响因素,采用2008-2010 年全国105 个土地市场较发育城市分季度地价数据,建立地价水平值与地价增长率影响因素的多层线性模型,定量分析了不同行政层次下,各影响因素对城市土地价格和地价增长率的影响程度。研究结论显示,地价水平值与地价增长率的影响因素不尽相同,且主导因素差异显著:在市级地价影响因素中,房地产投资增长是地价上升的直接动力,而地价增长率则主要受城市建设用地面积、房地产投资额的影响较;省级耕地保护政策对平抑地价、控制地价涨速作用显著,其中新增建设用地土地有偿使用费和耕地占用税是省级层次影响最显著的两项政策指标。 |

| [46] | . 地级市是我国经济发展相对迅速的区域, 也是土地供应重组、交易活跃的重点区域。以2005年我国土地出让面积、土地平均价格、地区生产总值、地区生产总值增长率和 固定资产投资等 5 个变量作为聚类指标, 构建自组织特征映射( SOFM) 人工神经网络模型, 将我国282 个地级市分为高地价发达区、低地价发达区、高地价欠发达区和低地价欠发达区共4 个类型区域, 并对每个类型区的土地价格和社会经济发展状况做出分析讨论。SOFM 模型聚类结果与客观实际较为吻合, 效果良好。结果表明, 自组织特征映射 网络对于地级市土地地价的区域差异具有良好的表征能力。 . 地级市是我国经济发展相对迅速的区域, 也是土地供应重组、交易活跃的重点区域。以2005年我国土地出让面积、土地平均价格、地区生产总值、地区生产总值增长率和 固定资产投资等 5 个变量作为聚类指标, 构建自组织特征映射( SOFM) 人工神经网络模型, 将我国282 个地级市分为高地价发达区、低地价发达区、高地价欠发达区和低地价欠发达区共4 个类型区域, 并对每个类型区的土地价格和社会经济发展状况做出分析讨论。SOFM 模型聚类结果与客观实际较为吻合, 效果良好。结果表明, 自组织特征映射 网络对于地级市土地地价的区域差异具有良好的表征能力。 |

| [47] | . How is it that Manhattan has a dense urban skyline, while Los Angeles does not '? How is it possible to find farmland within the city of Phoenix? Why is land in downtown Tokyo a thousand times more valuable than its suburban counterpart? This chapter begins a |

| [48] | . 土地价格与商品房价格到底是什么关系,是地价推高房价,还是房价推高地价,学术界一直存有争议。从逻辑上看,两者的相互影响是存在的,但具体是什么影响,则应进行实证分析。1998年以来,地价和房价均呈现出长期上升的趋势,以地价和房价来衡量的地价占房价的比重也呈现出长期上升的趋势。通过构建城市土地价格与商品房价格的四象限模型所进行的分析也发现,土地价格的变化会引起商品房价格的变化,土地价格的上升会推动房价的上涨。运用2002年1月至2012年12月中国商品房月度销售价格和单位面积土地购置费月度投资额的对数数据所进行的实证检验发现,商品房价格与土地价格呈正向协整关系,土地价格的均衡反向修复机制不成立,且从长期来看,商品房价格不是土地价格的Granger原因,土地价格是商品房价格的Granger原因,由此来看,要降低商品房价格就必须降低土地价格。 . 土地价格与商品房价格到底是什么关系,是地价推高房价,还是房价推高地价,学术界一直存有争议。从逻辑上看,两者的相互影响是存在的,但具体是什么影响,则应进行实证分析。1998年以来,地价和房价均呈现出长期上升的趋势,以地价和房价来衡量的地价占房价的比重也呈现出长期上升的趋势。通过构建城市土地价格与商品房价格的四象限模型所进行的分析也发现,土地价格的变化会引起商品房价格的变化,土地价格的上升会推动房价的上涨。运用2002年1月至2012年12月中国商品房月度销售价格和单位面积土地购置费月度投资额的对数数据所进行的实证检验发现,商品房价格与土地价格呈正向协整关系,土地价格的均衡反向修复机制不成立,且从长期来看,商品房价格不是土地价格的Granger原因,土地价格是商品房价格的Granger原因,由此来看,要降低商品房价格就必须降低土地价格。 |