)

) 1 南昌大学心理健康教育中心, 南昌 330031

2 中国科学院行为科学重点实验室(中国科学院心理研究所), 北京 100101

3 中国科学院大学心理学系, 北京 100049

4 SinSource HR Management Co., 福州 350001

5 福建工程学院交通运输学院, 福州 350118

收稿日期:2018-05-07出版日期:2019-03-15发布日期:2019-01-22通讯作者:许明星E-mail:xumx@fjut.edu.cn基金资助:国家自然科学基金项目(31471005);国家自然科学基金项目(71761167001);国家自然科学基金地区科学基金项目(71861027);国家社会科学基金重点项目(16AZD058);中国科学院行为科学重点实验室自主研究课题项目资助(Y5CX052003)The nudging role of behavioral economics in retirement savings decisions: Current situation and future prospects

LIU Huan1,2,3, SUI Xiao-Yang2,3, HUANG Yuan-Na2,3, LIN Rong-Ping4, XU Ming-Xing2( )

) 1 Centre for Mental Health, Nanchang University, Nanchang 330031, China

2 CAS Key Laboratory of Behavioral Science, Institute of Psychology, Chinese Academy of Sciences, Beijing 100101, China

3 Department of Psychology, University of Chinese Academy of Sciences, Beijing 100049, China

4 SinSource HR Management Co, Fuzhou 350001, China

5 School of Transportation, Fujian University of Technology, Fuzhou 350118, China

Received:2018-05-07Online:2019-03-15Published:2019-01-22Contact:XU Ming-Xing E-mail:xumx@fjut.edu.cn摘要/Abstract

摘要: “行为经济学之父”Richard Thaler因在行为经济学领域的突出贡献而获2017年诺贝尔经济学奖。Thaler利用行为经济学原理提出了“明日多储蓄”项目, 助推美国养老金储蓄率的提高。在初涉养老金储蓄领域时, Thaler提出采取“自动加入”的方式提高员工养老储蓄参与率; 接着提出采取“自动升级”的方式提高员工的储蓄率, 最终形成了“明日多储蓄”项目。“明日多储蓄”项目具有自由家长主义性质, 不仅能提高员工养老储蓄参与率、储蓄率, 还能优化资产投资配置。该项目产生了深远的影响:在应用层面上, 英国、新西兰等国家跟进推出了类似的养老储蓄政策; 在研究层面上, 一批后继研究者受此启发展开了个体养老金储蓄行为背后心理学机制的探索。结合中国养老储蓄三大支柱发展不平衡的现状, 我们提出可利用框架效应、心理账户、默认选项、将损失程数由双程变为单程等行为经济学手段助推中国养老储蓄的发展。国家可以考虑通过制度设计和政策制定助推全社会养老金参与率和缴纳水平的提高。

图/表 2

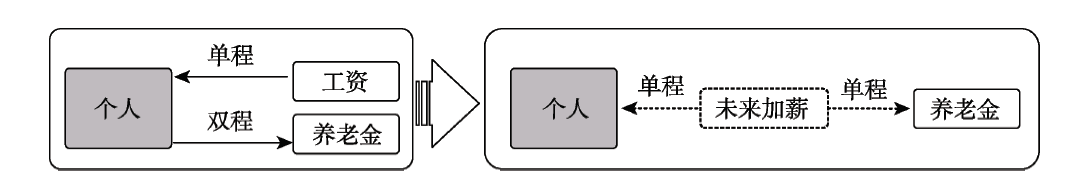

图1交税50元(双程损失), 退税50元(三程获得)

图1交税50元(双程损失), 退税50元(三程获得)

图1交税50元(双程损失), 退税50元(三程获得)

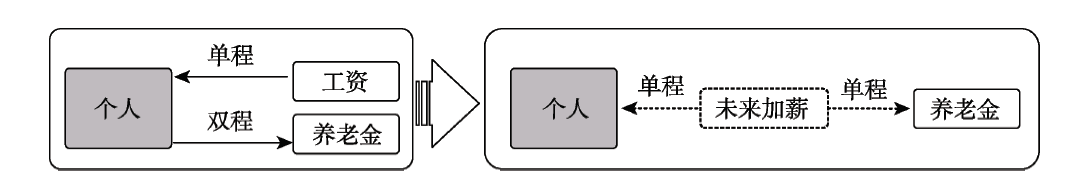

图2用已经到手的工资交养老金(左图:双程损失); 用未来加薪的工资交养老金(右图:单程损失)

图2用已经到手的工资交养老金(左图:双程损失); 用未来加薪的工资交养老金(右图:单程损失)

图2用已经到手的工资交养老金(左图:双程损失); 用未来加薪的工资交养老金(右图:单程损失)参考文献 45

| [1] | 董克用, 姚余栋 . (2017). 养老金融蓝皮书: 中国养老金融发展报告( 2017). 北京: 社会科学文献出版社. |

| [2] | Gigerenzer G., 栾胜华, 刘永芳 . ( 2019). 人非理性且难教化? 论支持自由家长主义的证据. 心理学报, 51( 4), 395-406. |

| [3] | 理查德·塞勒 . (2016).“错误的行为” (王晋译). 北京: 中信出版社. |

| [4] | 李纾 . ( 2016 a). 既非“胡萝卜”也非“大棒”: 助推社会发展的一条新捷径. 管理视野, ( 7), 92-96. |

| [5] | 李纾 . ( 2016b). 决策心理:齐当别之道. 上海: 华东师范大学出版社. |

| [6] | 李纾 . ( 2017). 如何提高员工的养老金储蓄率? 管理视野, 12月, 88-92. |

| [7] | 刘欢, 梁竹苑, 李纾 . ( 2009). 得失程数的变化: 损失规避现象的新视点. 心理学报, 41( 12), 1123-1132. doi: 10.3724/SP.J.024.2009.01123URL |

| [8] | 门杰丹, 张扬 . ( 2011. 男子中奖180万元难填欲壑, 挪用495万公款博彩. 2018-04-04取自 |

| [9] | 人力资源和社会保障部. ( 2017. 2017年前三季度人力资源和社会保障统计数据. 2018-03-29 取自 2017). 2017年前三季度人力资源和社会保障统计数据. 2018-03-29 取自 |

| [10] | 孙涛, 黄少安 . ( 2010). 非正规制度影响下中国居民储蓄、消费和代际支持的实证研究——兼论儒家文化背景下养老制度安排的选择. 经济研究, ( s1), 51-61. |

| [11] | 王增勤 . ( 2005). 博彩中奖后的毁灭. 检察风云, 4, 64-65. |

| [12] | 杨燕绥, 闫俊, 刘方涛 . ( 2012). 中国延税型养老储蓄政策的路径选择. 武汉金融, ( 8), 8-11. |

| [13] | 赵学农 . ( 2017). 个人商业养老保险市场分析与选择. 上海立信会计金融学院学报, ( 6), 50-55. |

| [14] | 中华人民共和国国家统计局. (主编).( 2017). 中国统计年鉴2017. 北京: 中国统计出版社. |

| [15] | Benartzi S., Beshears J., Milkman K. L., Sunstein C. R., Thaler R. H., Shankar M., .. Galing S . ( 2017). Should governments invest more in nudging? Psychological Science, 28( 8), 1041-1055. doi: 10.1177/0956797617702501URLpmid: 28581899 |

| [16] | Benartzi S., & Thaler R.H . ( 2013). Behavioral economics and the retirement savings crisis. Science, 339( 6124), 1152-1153. doi: 10.1126/science.1231320URL |

| [17] | Benartzi S., & Thaler R.H . ( 2007). Heuristics and biases in retirement savings behavior. Journal of Economic Perspectives, 21( 3), 81-104. doi: 10.1257/jep.21.3.81URL |

| [18] | Beshears J. L., Choi J. J., Laibson D.& Madrian B. C.. , ( 2006) . The importance of default options for retirement savings outcomes: Evidence from the united states. In B J Jeffery, J B Liebman, & D A Wise (Eds), Social security policy in a changing environment . (pp. 167-195). Chicago: University of Chicago Press. |

| [19] | Beshears J., Choi J. J., Laibson D., & Madrian B. C . ( 2013). Simplification and saving. Journal of Economic Behavior and Organization, 95, 130-145. |

| [20] | Beshears J., Choi J. J., Laibson D., Madrian B. C., & Milkman K. L . ( 2015). The effect of providing peer information on retirement savings decisions. Journal of Finance, 70( 3), 1161-1201. doi: 10.1111/jofi.12258URLpmid: 4452131 |

| [21] | Carroll G. D., Choi J. J., Laibson D., Madrian B. C., & Metrick A . ( 2009). Optimal defaults and active decisions. The Quarterly Journal of Economics, 124( 4), 1639-1674. doi: 10.1162/qjec.2009.124.4.1639URL |

| [22] | Chetty R., Friedman J. N., Leth-Petersen S., Nielsen T. H., & Olsen T . ( 2014). Active vs. passive decisions and crowd-out in retirement savings accounts: Evidence from Denmark. The Quarterly Journal of Economics, 129( 3), 1141-1219. doi: 10.1093/qje/qju013URL |

| [23] | Choi J. J., Laibson D., & Madrian B. C . ( 2004). Plan design and 401(k) savings outcomes. SSRN Electronic Journal, 57( 2), 275-298. doi: 10.2139/ssrn.557138URL |

| [24] | Choi J. J., Laibson D. & Madrian B. C.. , ( 2009) . Reducing the complexity costs of 401(k) participation: The case of quick enrollment. In D. A. Wise, (Ed.), Developments in the economics of aging (pp. 57-82). Chicago: University of Chicago Press. doi: 10.7208/chicago/9780226903361.003.0003URL |

| [25] | Duflo E., Gale W., Liebman J., Orszag P., & Saez E . ( 2007). Savings incentives for low-and moderate-income families in the united states: Why is the saver’s credit not more effective? Journal of the European Economic Association, 5( 2-3), 647-661. doi: 10.1162/jeea.2007.5.2-3.647URL |

| [26] | Duflo E. & Saez E., ( 2002). Participation and investment decisions in a retirement plan: The influence of colleagues’ choices. Journal of Public Economics, 85( 1), 121-148. doi: 10.1016/S0047-2727(01)00098-6URL |

| [27] | Duflo E. & Saez E., ( 2003). The role of information and social interactions in retirement plan decisions: Evidence from a randomized experiment. Quarterly Journal of Economics, 118( 3), 815-842. doi: 10.2139/ssrn.315659URLpmid: 5443486 |

| [28] | Dugas C. , ( 2002, July 19). Retirement crisis looms as many come up short. USA Today. |

| [29] | Ersner-Hershfield H., Garton M. T., Ballard K., Samanez-larkin G. R., & Knutson B . ( 2009). Don’t stop thinking about tomorrow: Individual differences in future self-continuity account for saving. Judgment and Decision Making, 4( 4), 280-286. doi: 10.1080/03071847209434499URLpmid: 2747683 |

| [30] | Gilovich T., Griffin D.& Kahneman D.. ,( 2002) . Heuristics and biases: The psychology of intuitive judgment . New York, NY, US: Cambridge University Press. |

| [31] | Gilovich T Gov. uk. ( 2008). National Employment Savings Trust (NEST). Retrieved April 4, 2018, from |

| [32] | Hershfield H.E . ( 2011). Future self-continuity: How conceptions of the future self transform intertemporal choice. Annals of the New York Academy of Sciences, 1235, 30-43. doi: 10.1111/j.1749-6632.2011.06201.xURLpmid: 3764505 |

| [33] | Hershfield H. E., Goldstein D. G., Sharpe W. F., Fox J., Yeykelis L., Carstensen L. L., & Bailenson J. N . ( 2011). Increasing saving behavior through age-progressed renderings of the future self. Journal of Marketing Research, 48( 1), S23-S37. doi: 10.1509/jmkr.48.SPL.S23URLpmid: 3949005 |

| [34] | ICI.ORG. ( 2015. “2015 Investment Company Fact Book——A review of trends and activities in the US. Investment Company Industry”. Retrieved June 10, 2018, from |

| [35] | Kahneman D. & Tversky A., ( 1979). Prospect theory: An analysis of decision making under risk. Econometrica, 47( 2), 263-291. doi: 10.2307/1914185URL |

| [36] | L?ckenhoff C. E., De Fruyt F., Terracciano A., McCrae R. R., De Bolle M., Costa P. T., .. Yik M . ( 2009). Perceptions of aging across 26 cultures and their culture-level associates. Psychology and Aging, 24( 4), 941-954. doi: 10.1037/a0016901URLpmid: 20025408 |

| [37] | Madrian B.C., & Shea D.F . ( 2001). The power of suggestion: Inertia in 401(k) participation and savings behavior. The Quarterly Journal of Economics, 116( 4), 1149-1187. doi: 10.2139/ssrn.223635URL |

| [38] | Munnell A., Webb A., & Delorme L . ( 2006). Retirements at risk: A new national retirement risk index. Boston College Center for Retirement Research, June. |

| [39] | New Zealand Government. ( 2007. Retirement saving made easy. Retrieved April 4, 2018, from |

| [40] | Rebonato R.. ( 2012). Taking liberties: A critical examination of Libertarian paternalism. Basingstoke, UK:Palgrave Macmillan. |

| [41] | Skinner J.. ( 2007). Are you sure you’re saving enough for retirement? Journal of Economic Perspectives, 21( 3), 59-80. doi: 10.1257/jep.21.3.59URL |

| [42] | Thaler R.H . ( 1994). Psychology and savings policies. American Economic Review, 84( 2), 186-192. |

| [43] | Thaler R.H., & Benartzi S. , ( 2004). Save more tomorrow?: Using behavioral economics to increase employee saving. Journal of Political Economy, 112( S1), S164-S187. doi: 10.1086/380085URL |

| [44] | The Royal Swedish Academy of Sciences. ( 2017). Press release: The prize in economic sciences 2017.. Retrieved March 19, 2018, from |

| [45] | Wechsler H., Nelson T. E., Lee J. E., Seibring M., Lewis C., & Keeling R. P . ( 2003). Perception and reality: A national evaluation of social norms marketing interventions to reduce college students’ heavy alcohol use. Journal of Studies on Alcohol, 64( 4), 484-494. doi: 10.15288/jsa.2003.64.484URLpmid: 12921190 |

相关文章 15

| [1] | 黄元娜, 李云箫, 李纾. 为什么被选的和被拒的会是同一个备择选项?[J]. 心理科学进展, 2021, 29(6): 1010-1021. |

| [2] | 陈彦垒, 胡志坚. 傅斯年的心理学探索及其贡献[J]. 心理科学进展, 2021, 29(6): 1131-1140. |

| [3] | 李佳洁, 于彤彤. 基于助推的健康饮食行为干预策略[J]. 心理科学进展, 2020, 28(12): 2052-2063. |

| [4] | 徐富明, 黄龙, 张慧. 随机控制实验:助推脱贫的现场干预研究[J]. 心理科学进展, 2020, 28(11): 1953-1960. |

| [5] | 赵晓颖, 李爱梅, 王海侠. 助推目标实现:时间标记的动力效应[J]. 心理科学进展, 2019, 27(7): 1275-1293. |

| [6] | 谢铠杰, 马家涛, 何铨, 江程铭. 描述性规范提升义务献血的意愿而非行为[J]. 心理科学进展, 2019, 27(6): 1019-1024. |

| [7] | 刘永芳, 范雯健, 侯日霞. 从理论到研究, 再到应用:塞勒及其贡献[J]. 心理科学进展, 2019, 27(3): 381-393. |

| [8] | 刘培, 冯一丹, 李爱梅, 刘伟, 谢健飞. 揭秘经济管理中的行为异象:心理账户理论的应用启示[J]. 心理科学进展, 2019, 27(3): 406-417. |

| [9] | 张书维, 梁歆佚, 岳经纶. 行为社会政策:“助推”公共福利的实践与探索[J]. 心理科学进展, 2019, 27(3): 429-438. |

| [10] | 傅鑫媛, 辛自强, 楼紫茜, 高琰. 基于助推的环保行为干预策略[J]. 心理科学进展, 2019, 27(11): 1939-1950. |

| [11] | 徐富明;史燕伟;李欧;张慧;李燕. 民众收入不公平感的机制与对策——基于参照依赖和损失规避双视角[J]. 心理科学进展, 2016, 24(5): 665-675. |

| [12] | 李彬;徐富明;王伟;张慧;罗寒冰. 损失规避的产生根源[J]. 心理科学进展, 2014, 22(8): 1319-1327. |

| [13] | 高飞;张蔚蔚;潘孝富. 通货膨胀知觉的认知机制和影响因素[J]. 心理科学进展, 2013, 21(1): 125-134. |

| [14] | 张鸿飞;徐富明;刘腾飞;张军伟;蒋多. 赢者诅咒:心理机制、影响因素及应对策略[J]. 心理科学进展, 2011, 19(5): 664-672. |

| [15] | 马向阳;徐富明;吴修良;黄宝珍;黄雅凌. 行为决策中的忽略偏差:心理机制与影响因素[J]. 心理科学进展, 2011, 19(12): 1834-1841. |

PDF全文下载地址:

http://journal.psych.ac.cn/xlkxjz/CN/article/downloadArticleFile.do?attachType=PDF&id=4614