), 梁竹苑2,3(

), 梁竹苑2,3( )

) 1暨南大学管理学院, 广州 510632

2中国科学院行为科学重点实验室(中国科学院心理研究所), 北京 100101

3中国科学院大学心理学系, 北京 100049

4德国汉堡大学医学院系统神经科学系, 汉堡 20246

收稿日期:2018-05-11出版日期:2019-03-25发布日期:2019-01-22通讯作者:李纾,梁竹苑E-mail:lishu@psych.ac.cn;liangzy@psych.ac.cn基金资助:* 国家自然科学基金青年项目(71801110);国家自然科学基金面上项目(71471171);国家自然科学基金面上项目(31471005);国家自然科学基金面上项目(71571087);教育部人文社会科学研究青年基金项目(18YJC630268);中国博士后科学基金资助项目(2018M633270);中国科学院行为科学重点实验室自主研究课题项目(Y5CX052003);广东省自科重大培育项目资助(2017A030308013)Similarity in processes of risky choice and intertemporal choice: The case of certainty effect and immediacy effect

ZHOU Lei1,2,3, LI Ai-Mei1, ZHANG Lei4, LI Shu2,3( ), LIANG Zhu-Yuan2,3(

), LIANG Zhu-Yuan2,3( )

) 1 Management School, Jinan University, Guangzhou 510632, China

2 CAS Key Laboratory of Behavioral Science, Institute of Psychology, Beijing 100101, China

3 Department of Psychology, University of Chinese Academy of Sciences, Beijing 100049, China

4 Institute for Systems Neuroscience, University Medical Center Hamburg-Eppendorf, Hamburg 20246, Germany

Received:2018-05-11Online:2019-03-25Published:2019-01-22Contact:LI Shu,LIANG Zhu-Yuan E-mail:lishu@psych.ac.cn;liangzy@psych.ac.cn摘要/Abstract

摘要: 风险决策和跨期决策与人类生存发展密切相关, 且两类决策在理论发展、行为效应及神经基础等方面具有相似性。为检验二者是否具有共同过程机制, 本研究以风险决策中的确定效应和跨期决策中的即刻效应为例, 采用眼动追踪技术比较了它们的局部、整体过程及模型拟合。辅以贝叶斯因子分析实验数据表明:二者的主要过程特征均相似, 且更符合非折扣模型假设; 二者在加工复杂程度等少数特征上有所不同; 确定和即刻信息在加工方向等特征上存在特异性。这表明二者可能具有共同的核心决策规则:两类决策更可能遵循非折扣模型预期的简捷、启发式规则, 而不是折扣模型所假设的补偿性、基于选项规则。本研究为建立两类决策的共同解释框架做出了有益尝试, 并为决策比较研究方法提供新的方向。

图/表 10

图1实验流程示意图

图1实验流程示意图

图1实验流程示意图

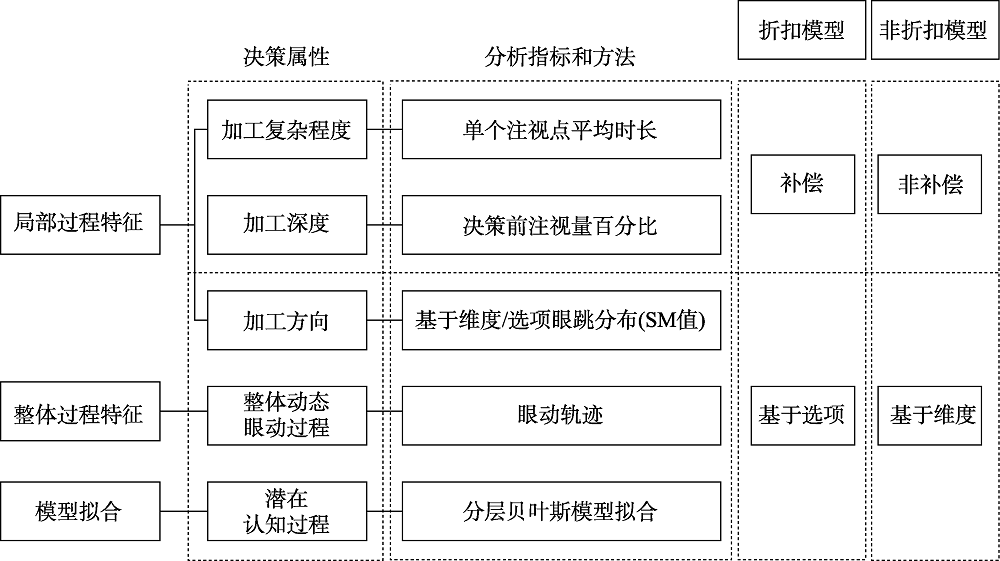

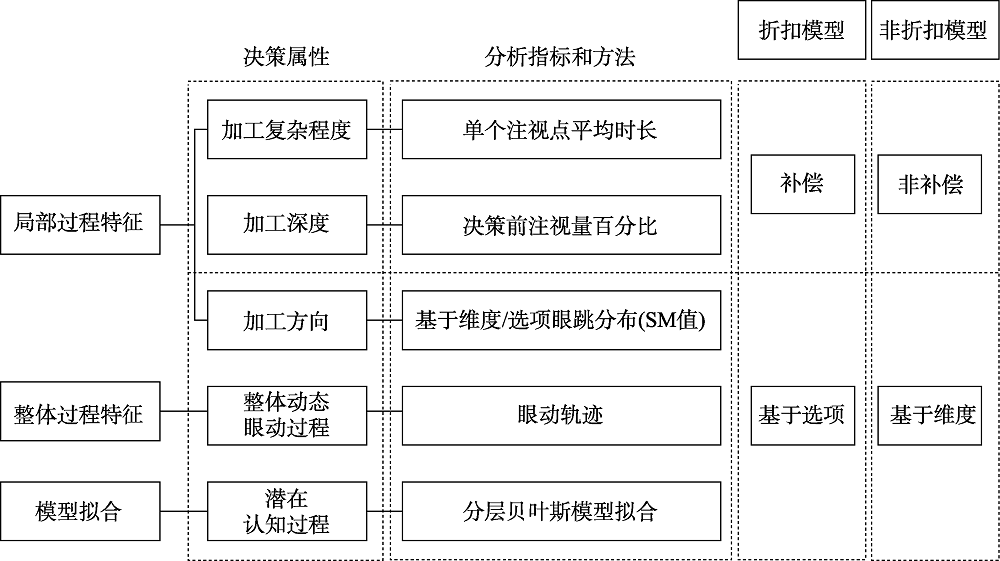

图2研究逻辑与分析框架

图2研究逻辑与分析框架

图2研究逻辑与分析框架

图3行为特征比较结果(M ± SE)

图3行为特征比较结果(M ± SE)

图3行为特征比较结果(M ± SE)

图4加工复杂程度过程特征比较结果(M ± SE)

图4加工复杂程度过程特征比较结果(M ± SE)

图4加工复杂程度过程特征比较结果(M ± SE)

图5加工深度过程特征比较结果(M ± SE)

图5加工深度过程特征比较结果(M ± SE)

图5加工深度过程特征比较结果(M ± SE)

图6加工方向过程特征比较结果(M ± SE)

图6加工方向过程特征比较结果(M ± SE)

图6加工方向过程特征比较结果(M ± SE)

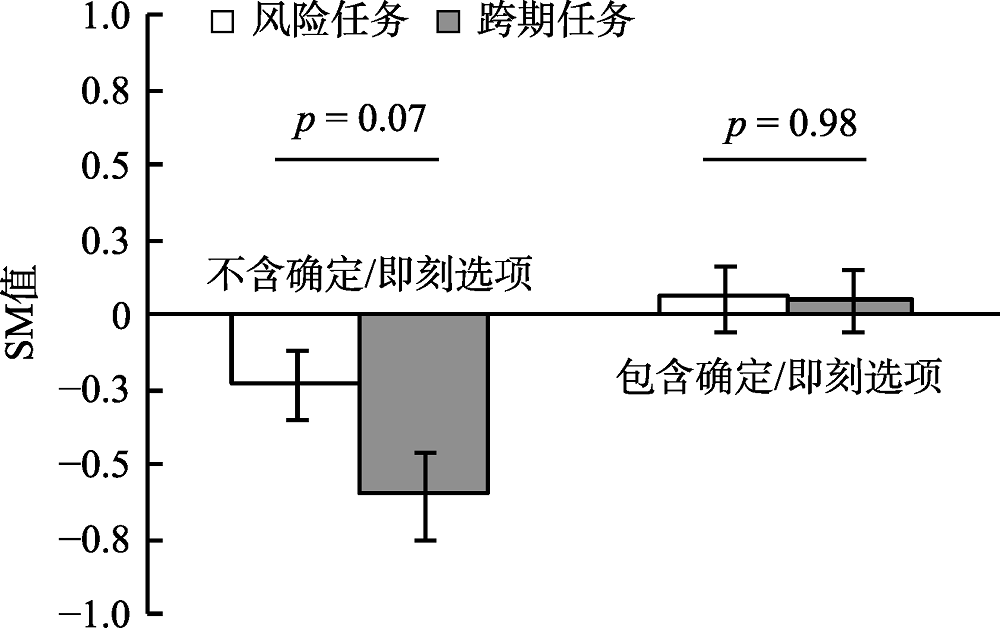

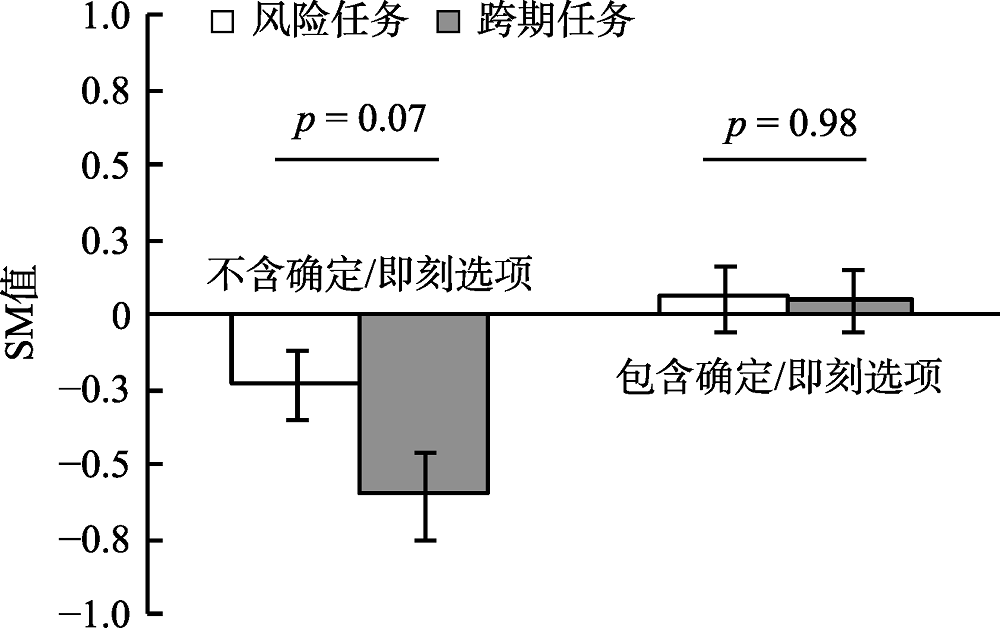

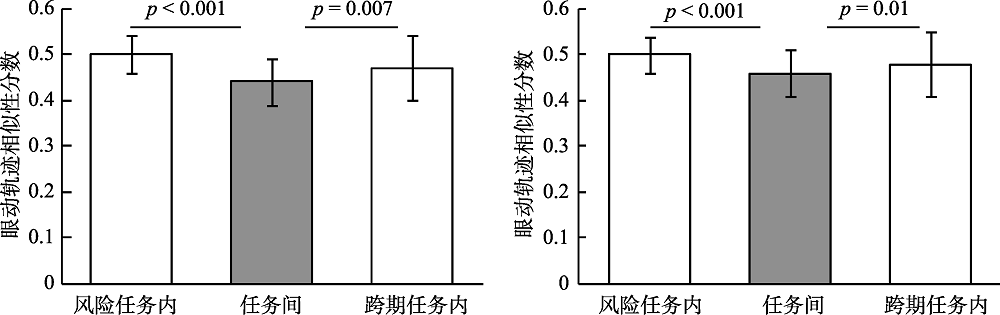

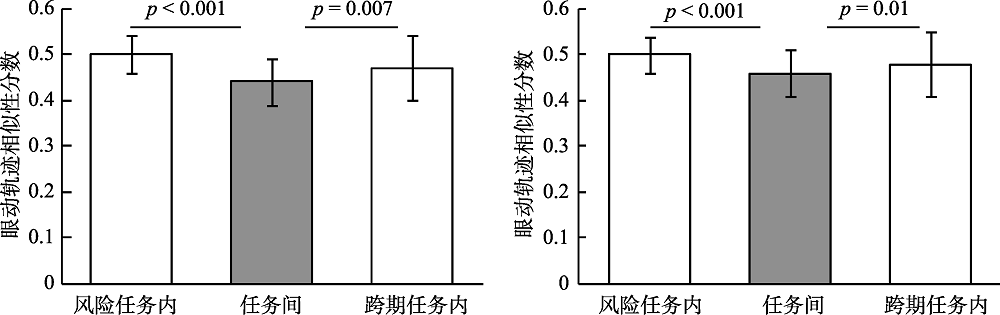

图7眼动轨迹相似性分数比较结果(M ± SE) (左:不含确定/即刻条件, 右:包含确定/即刻条件)

图7眼动轨迹相似性分数比较结果(M ± SE) (左:不含确定/即刻条件, 右:包含确定/即刻条件)

图7眼动轨迹相似性分数比较结果(M ± SE) (左:不含确定/即刻条件, 右:包含确定/即刻条件)

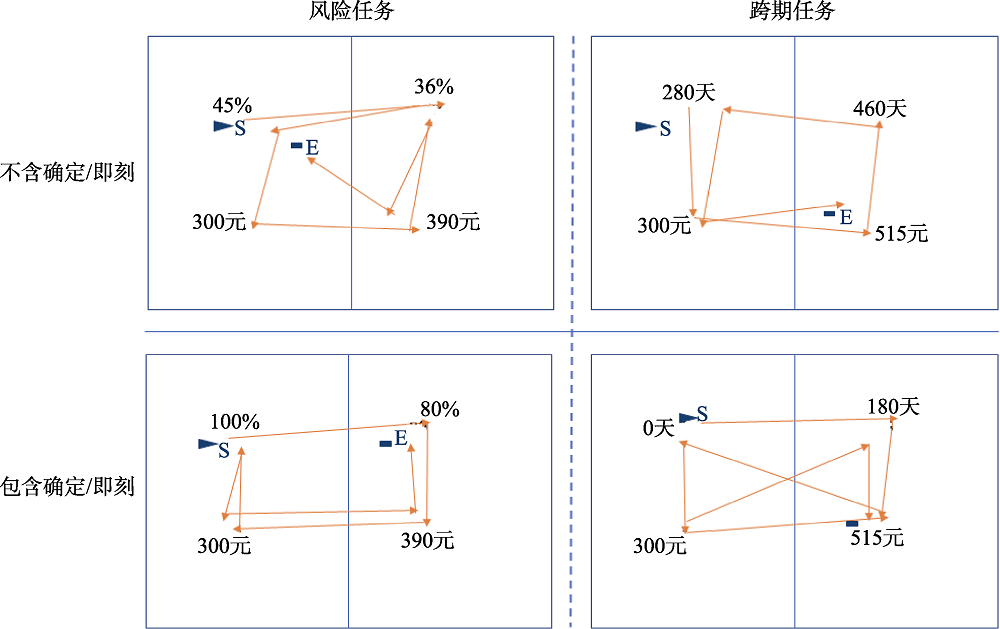

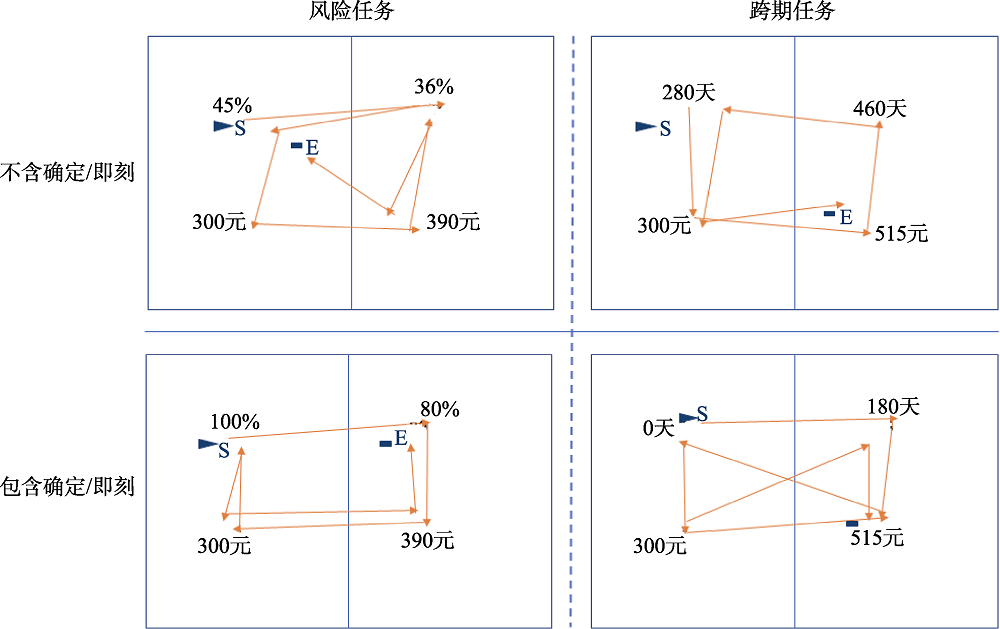

图8各任务条件中典型试次的眼动轨迹 注:箭头代表眼动轨迹的方向, S代表起始位置, E代表终止位置。

图8各任务条件中典型试次的眼动轨迹 注:箭头代表眼动轨迹的方向, S代表起始位置, E代表终止位置。

图8各任务条件中典型试次的眼动轨迹 注:箭头代表眼动轨迹的方向, S代表起始位置, E代表终止位置。表1分层贝叶斯模型拟合结果

| 模型类别 | 模型 | 风险决策任务 | 跨期决策任务 | ||

|---|---|---|---|---|---|

| WAIC | 预测率 | WAIC | 预测率 | ||

| 折扣模型 | 指数模型 | 1169.51 | 61.79% | 885.61 | 71.60% |

| 双曲线模型 | 1325.38 | 54.91% | 787.39 | 76.01% | |

| 非折扣模型 | 启发式模型 | 682.42 | 80.46% | 595.59 | 84.32% |

表1分层贝叶斯模型拟合结果

| 模型类别 | 模型 | 风险决策任务 | 跨期决策任务 | ||

|---|---|---|---|---|---|

| WAIC | 预测率 | WAIC | 预测率 | ||

| 折扣模型 | 指数模型 | 1169.51 | 61.79% | 885.61 | 71.60% |

| 双曲线模型 | 1325.38 | 54.91% | 787.39 | 76.01% | |

| 非折扣模型 | 启发式模型 | 682.42 | 80.46% | 595.59 | 84.32% |

表2过程特征检验和模型拟合结果小结

| 决策特征 | 决策属性 | 分析指标 | 决策过程规则 | |||

|---|---|---|---|---|---|---|

| 风险任务 | 跨期任务 | |||||

| 包含确定/ 即刻选项 | 不含确定/ 即刻选项 | 包含确定/ 即刻选项 | 不含确定/ 即刻选项 | |||

| 局部过程特征 | 加工复杂程度 | 单个注视点平均时长/长注视点比例 | 非补偿 | 非补偿 | 非补偿 | 非补偿 |

| 加工深度 | 注视量百分比 | 非补偿 | 非补偿 | 非补偿 | 非补偿 | |

| 加工方向 | SM值 | 无占优规则 | 基于维度 | 无占优规则 | 基于维度 | |

| 整体过程特征 | 整体动态的眼动过程 | 眼动轨迹 | 无占优规则 | 基于维度 | 无占优规则 | 无占优规则 |

| 模型拟合 | 潜在的认知过程 | 分层贝叶斯模型拟合 | 基于维度 | 基于维度 | 基于维度 | 基于维度 |

表2过程特征检验和模型拟合结果小结

| 决策特征 | 决策属性 | 分析指标 | 决策过程规则 | |||

|---|---|---|---|---|---|---|

| 风险任务 | 跨期任务 | |||||

| 包含确定/ 即刻选项 | 不含确定/ 即刻选项 | 包含确定/ 即刻选项 | 不含确定/ 即刻选项 | |||

| 局部过程特征 | 加工复杂程度 | 单个注视点平均时长/长注视点比例 | 非补偿 | 非补偿 | 非补偿 | 非补偿 |

| 加工深度 | 注视量百分比 | 非补偿 | 非补偿 | 非补偿 | 非补偿 | |

| 加工方向 | SM值 | 无占优规则 | 基于维度 | 无占优规则 | 基于维度 | |

| 整体过程特征 | 整体动态的眼动过程 | 眼动轨迹 | 无占优规则 | 基于维度 | 无占优规则 | 无占优规则 |

| 模型拟合 | 潜在的认知过程 | 分层贝叶斯模型拟合 | 基于维度 | 基于维度 | 基于维度 | 基于维度 |

参考文献 74

| [1] | Ahn W.-Y., Haines N., &Zhang L . ( 2017). Revealing neuro- computational mechanisms of reinforcement learning and decision-making with the hBayesDM package. Computational Psychiatry, 1, 24-57. doi: 10.1162/cpsy_a_00002 doi: 10.1162/CPSY_a_00002URL |

| [2] | Allais M . ( 1953). Le comportement de l'homme rationnel devant le risque: Critique des postulats et axioms de l'ecole americaine [Rational man's behavior in face of risk: Critique of the American School's postulates and axioms]. Econometrica Quick Links, 21, 503-546. |

| [3] | Böckenholt U., &Hynan L.S . ( 1994). Caveats on a process- tracing measure and a remedy. Journal of Behavioral Decision Making, 7( 2), 103-117. doi: 10.1002/bdm.3960070203 doi: 10.1002/bdm.3960070203URL |

| [4] | Brandstätter E., Gigerenzer G., &Hertwig R . ( 2006). The priority heuristic: Making choices without trade-offs. Psychological Review, 113( 2), 409-432. doi: 10.1037/0033-295X.113.2.409 doi: 10.1037/0033-295X.113.2.409URLpmid: 2891015 |

| [5] | Brandstätter E., &Körner C. ( 2014). Attention in risky choice. Acta Psychologica, 152, 166-176. doi: 10.1016/j.actpsy.2014. 08.008 |

| [6] | Burnham K.P., &Anderson D.R . ( 2004). Multimodel inference: Understanding AIC and BIC in model selection. Sociological Methods & Research, 33( 2), 261-304. doi: 10.1177/0049124104268644 |

| [7] | Dai J., &Busemeyer J.R . ( 2014). A probabilistic, dynamic, and attribute-wise model of intertemporal choice. Journal of Experimental Psychology: General, 143( 4), 1489-1514. doi: 10.1037/a0035976 doi: 10.1037/a0035976URLpmid: 4115005 |

| [8] | Ericson K. M. M., White J. M., Laibson D. I., &Cohen J. D . ( 2015). Money earlier or later? Simple heuristics explain intertemporal choices better than delay discounting does. Psychological Science, 26( 6), 826-833. doi: 10.1177/ 0956797615572232 doi: 10.1177/0956797615572232URLpmid: 4516222 |

| [9] | Fiedler S., &Glöckner A. ( 2012). The dynamics of decision making in risky choice: An eye-tracking analysis. Frontiers Psychology , 3, 335. doi: 10.3389/fpsyg.2012.00335 doi: 10.3389/fpsyg.2012.00335URLpmid: 3498888 |

| [10] | Figner B., Knoch D., Johnson E. J., Krosch A. R., Lisanby S. H., Fehr E., &Weber E. U . ( 2010). Lateral prefrontal cortex and self-control in intertemporal choice. Nature Neuroscience, 13( 5), 538-539. doi: 10.1038/nn.2516 doi: 10.1038/nn.2516URLpmid: 20348919 |

| [11] | , , Fisher G., &Rangel A. ( 2013). Intertemporal discount rates are mediated by relative attention. Paper presented at Society for Judgment and Decision Making Annual Conference, Toronto, Canada. |

| [12] | Franco-Watkins A. M., Mattson R. E., &Jackson M. D . ( 2016). Now or later? Attentional processing and intertemporal choice. Journal of Behavioral Decision Making, 29( 2-3), 206-217. doi: 10.1002/bdm.1895 doi: 10.1002/bdm.1895URL |

| [13] | Frederick S., Loewenstein G., &O'donoghue T . ( 2002). Time discounting and time preference: A critical review. Journal of Economic Literature, 40( 2), 351-401. doi: 10.1257/ 002205102320161311 doi: 10.1257/002205102320161311URL |

| [14] | Gelman A., Carlin J. B., Stern H. S., Dunson D. B., Vehtari A., &Rubin, D. B. ( 2014) . Bayesian data analysis (3rd ed.). New York, NY: CRC Press. |

| [15] | Gelman A., &Rubin D.B . ( 1992). Inference from iterative simulation using multiple sequences. Statistical Science, 7( 4), 457-472. doi: 10.1214/ss/1177011136 doi: 10.1214/ss/1177011136URL |

| [16] | Glöckner A., &Herbold A-K . ( 2011). An eye-tracking study on information processing in risky decisions: Evidence for compensatory strategies based on automatic processes. Journal of Behavioral Decision Making, 24( 1), 71-98. doi: 10.1002/bdm.684 doi: 10.1002/bdm.684URL |

| [17] | Green L., Myerson J., &Ostaszewski P . ( 1999). Amount of reward has opposite effects on the discounting of delayed and probabilistic outcomes. Journal of Experimental Psychology: Learning, Memory, and Cognition, 25( 2), 418-427. doi: 10.1037/0278-7393.25.2.418 doi: 10.1037/0278-7393.25.2.418URLpmid: 10093208 |

| [18] | Green L., Myerson J., &Vanderveldt, A. . (2014) Delay and probability discounting. In: F. K. McSweeney & E. Murphy (Eds.), Wiley-Blackwell Handbook of Operant and Classical Conditioning (pp. 307-337). Chichester, England: Wiley. |

| [19] | Hardisty D.J., &Pfeffer J. ( 2016). Intertemporal uncertainty avoidance: When the future is uncertain, people prefer the present, and when the present is uncertain, people prefer the future. Management Science, 63( 2), 519-527. doi: 10.1287/mnsc.2015.2349 doi: 10.2139/ssrn.2656662URL |

| [20] | Horstmann N. ( 2009). How distinct are intuition and deliberation? An eye-tracking analysis of instruction-induced decision modes. Judgment and Decision Making, 4( 5), 335-354. doi: 10.2139/ssrn.1393729 doi: 10.2139/ssrn.1393729URL |

| [21] | Hu C-P., Kong X-Z., Wagenmakers E-J., Ly A., &Peng K-P . ( 2018). The bayes factor and its implementation in JASP: A pratical primer. 26(6), 951-965. doi: 10.3724/SP. J.1042.2018.00951 |

| [ 胡传鹏, 孔祥祯, Wagenmakers, E-J., Ly A., 彭凯平 . ( 2018). 贝叶斯因子及其在JASP中的实现. 心理科学进展, 26( 6), 951-965.] | |

| [22] | JASP Team . ( 2017). JASP (Version 0. 8.2) [Computer software] |

| [23] | Jeffreys H. ( 1961). Theory of probability (3rd ed.). Oxford, UK: Oxford University Press. |

| [24] | Kable J.W., &Glimcher P.W . ( 2007). The neural correlates of subjective value during intertemporal choice. Nature Neuroscience, 10( 12), 1625-1633. doi: 10.1038/nn2007 doi: 10.1038/nn2007URLpmid: 2845395 |

| [25] | Kahneman D., &Tversky A. ( 1979). Prospect theory: An analysis of decision under risk. Econometrica, 47( 2), 263-291. doi: 10.2307/1914185 doi: 10.2307/1914185URL |

| [26] | Kahneman D., &Tversky A. ( 1984). Choices, values, and frames. American Psychologist, 39( 4), 341-350. doi: 10.1037/0003-066X.39.4.341URL |

| [27] | Kirby K.N., &Herrnstein R.J . ( 1995). Preference reversals due to myopic discounting of delayed reward. Psychological Science, 6( 2), 83-89. doi: 10.1111/j.1467-9280.1995.tb00311.x doi: 10.1111/j.1467-9280.1995.tb00311.xURL |

| [28] | Konstantinidis E., van Ravenzwaaij D., &Newell B. R . ( 2017). Exploring the decision dynamics of risky intertemporal choice. Proceedings of the 39th Annual Conference of the Cognitive Science Society, 694-699. Retrieved from |

| [29] | Kuhnen C.M., &Knutson B. ( 2005). The neural basis of financial risk taking. Neuron, 47( 5), 763-770. doi: 10.1016/j.neuron.2005.08.008 doi: 10.1016/j.neuron.2005.08.008URLpmid: 16129404 |

| [30] | Li S. ( 2004). A behavioral choice model when computational ability matters. Applied Intelligence, 20( 2), 147-163. doi: 10.1023/B:APIN.0000013337.01711.c7 doi: 10.1023/B:APIN.0000013337.01711.c7URL |

| [31] | Li S., Su Y., &Sun Y . ( 2010). The effect of pseudo-immediacy on intertemporal choices . Journal of Risk Research. 13( 6), 781-787. doi: 10.1080/13669870903551704 doi: 10.1080/13669870903551704URL |

| [32] | Liang Z-Y., Zhou L., &Su Y . ( 2016, Aug.). The hidden-zero effect in risky choice: An eye-tracking study. Paper presented at the 31th International Congress of Psychology, Yokohama, JAPAN. |

| [33] | Luckman A., Donkin C., &Newell B. R . ( 2017). Can a single model account for both risky choices and inter-temporal choices? Testing the assumptions underlying models of risky inter-temporal choice. Psychonomic Bulletin & Review, 25, 785-792. doi: 10.3758/s13423-017-1330-8 doi: 10.3758/s13423-017-1330-8URLpmid: 28600719 |

| [34] | Loewenstein G., &Prelec D. ( 1992). Anomalies in intertemporal choice: Evidence and an interpretation. The Quarterly Journal of Economics, 107( 2), 573-597. doi: 10.1006/obhd.1996.0028 doi: 10.2307/2118482URL |

| [35] | Ly A., Verhagen J., &Wagenmakers E.-J . ( 2016 a). An evaluation of alternative methods for testing hypotheses, from the perspective of Harold Jeffreys. Journal of Mathematical Psychology, 72, 43-55. doi: 10.1016/j.jmp.2016.01.003 doi: 10.1016/j.jmp.2016.01.003URL |

| [36] | Ly A., Verhagen J., &Wagenmakers E-J . ( 2016 b). Harold Jeffreys’s default Bayes factor hypothesis tests: Explanation, extension, and application in psychology. Journal of Mathematical Psychology, 72, 19-32. doi: 10.1016/j.jmp. 2015.06.004 doi: 10.1016/j.jmp.2015.06.004URL |

| [37] | Magen E., Dweck C., &Gross J. J . ( 2008). The hidden-zero effect: Representing a single choice as an extended sequence reduces impulsive choice. Psychological Science, 19( 7), 648-649. doi: 10.1111/j.1467-9280.2008.02137.x doi: 10.1111/j.1467-9280.2008.02137.xURL |

| [38] | Marsman M., &Wagenmakers E-J . ( 2017). Bayesian benefits with JASP. European Journal of Developmental Psychology, 14( 5), 545-555. doi: 10.1080/17405629.2016.1259614 doi: 10.1080/17405629.2016.1259614URL |

| [39] | Mazur J.E . ( 1987). An adjusting procedure for studying delayed reinforcement. In M. L. Commons, J. E. Mazur, J. A. Nevin, & H. Rachlin(Eds.), Quantitative analyses of behavior: Vol. 5. The effect of delay and of intervening events on reinforcement value |

| [40] | McClure S. M., Laibson D. I., Loewenstein G., &Cohen J. D . ( 2004). Separate neural systems value immediate and delayed monetary rewards. Science, 306( 5695), 503-507. doi: 10.1126/science.1100907 |

| [41] | Myerson J., Green L., Hanson S. J., Holt D. D., &Estle S. J . ( 2003). Discounting delayed and probabilistic rewards: Processes and traits. Journal of Economic Psychology, 24( 5), 619-635. doi: 10.1016/S0167-4870(03)00005-9 doi: 10.1016/S0167-4870(03)00005-9URL |

| [42] | Noton D., &Stark L. ( 1971). Scanpaths in eye movements during pattern perception. Science, 171( 3968), 308-311. doi: 10.1126/science.171.3968.308 doi: 10.1126/science.171.3968.308URLpmid: 5538847 |

| [43] | Pascal B. ( 1670). Pensées (W. F. Trotter, Trans.). Retrieved Nov. 22, 2018, from |

| [44] | Rao L-L, &Li S. ( 2011). New paradoxes in intertemporal choice. Judgment and Decision Making, 6( 2), 122-129. |

| [45] | Rayner K. (Ed.) ( 2013). Eye movements and visual cognition: Scene perception and reading. New York:Springer-Verlag. doi: 10.1007/978-1-4612-2852-3 |

| [46] | Read D., Frederick S., &Scholten M . ( 2013). DRIFT: An analysis of outcome framing in intertemporal choice. Journal of Experimental Psychology: Learning, Memory, and Cognition, 39( 2), 573-588. doi: 10.1037/a0029177 doi: 10.1037/a0029177URLpmid: 22866891 |

| [47] | Read D., Loewenstein G., &Kalyanaraman S . ( 1999). Mixing virtue and vice: Combining the immediacy effect and the diversification heuristic. Journal of Behavioral Decision Making, 12( 4), 257-273. doi: 10.1002/(SICI)1099-0771 (199912)12:4%3C257::AID-BDM327%3E3.0.CO;2-6 |

| [48] | Reeck C., Wall D., &Johnson E. J . ( 2017). Search predicts and changes patience in intertemporal choice. Proceedings of the National Academy of Sciences, 114( 45), 11890-11895. doi: 10.1073/pnas.1707040114 doi: 10.1073/pnas.1707040114URLpmid: 29078303 |

| [49] | Rouder J. N., Speckman P. L., Sun D. C., Morey R. D., &Iverson G . ( 2009). Bayesian t-tests for accepting and rejecting the null hypothesis. Psychonomic Bulletin & Review, 16, 225-237. doi: 10.3758/PBR.16.2.225 doi: 10.3758/PBR.16.2.225URLpmid: 19293088 |

| [50] | Samuelson P.A . ( 1937). A note on measurement of utility. The Review of Economic Studies, 4( 2), 155-161. doi: 10.2307/2967661URL |

| [51] | Scheibehenne B., &Pachur T. ( 2015). Using Bayesian hierarchical parameter estimation to assess the generalizability of cognitive models of choice. Psychonomic Bulletin & Review, 22( 2), 391-407. doi: 10.3758/s13423-014-0684-4 doi: 10.3758/s13423-014-0684-4URLpmid: 25134469 |

| [52] | Schneider E., Streicher B., Lermer E., Sachs R., &Frey D . ( 2017). Measuring the zero-risk bias: Methodological artefact or decision-making strategy? Zeitschrift für Psychologie, 225, 31-44. doi: 10.1027/2151-2604/a000284 |

| [53] | Schulte-Mecklenbeck M., Johnson J. G., Böckenholt U., Goldstein D. G., Russo J. E., Sullivan N. J., &Willemsen M. C . ( 2017). Process-tracing methods in decision making: On growing up in the 70s. Current Directions in Psychological Science, 26( 5), 442-450. doi: 10.1177/0963721417708229 doi: 10.1177/0963721417708229URL |

| [54] | Schulte-Mecklenbeck M., Kühberger A., Gagl B., &Hutzler F . ( 2017). Inducing thought processes: Bringing process measures and cognitive processes closer together. Journal of Behavioral Decision Making, 30( 5), 1001-1013. doi: 10.1002/bdm.2007 doi: 10.1002/bdm.2007URL |

| [55] | Scholten M., &Read D. ( 2010). The psychology of intertemporal tradeoffs. Psychological Review, 117( 3), 925-944. doi: 10.1037/a001 doi: 10.1037/a0019619URLpmid: 20658858 |

| [56] | Simon H. A. ( 1982). Models of Bounded Rationality: Empirically grounded economic reason. Cambridge, US: MIT Press. |

| [57] | Stewart N., Hermens F., &Matthews W. J . ( 2015). Eye movements in risky choice. Journal of Behavioral Decision Making, 29( 2-3), 116-136. doi: 10.1002/bdm.1854 doi: 10.1002/bdm.1854URL |

| [58] | Stevens J. R. ( 2011). Mechanisms for decisions about the future. In R. Menzel, & J. Fischer (Eds.) Animal thinking: Contemporary issues in comparative cognition (pp. 93- 104) . Cambridge, MA: MIT Press. |

| [59] | Stevenson M. K., Busemeyer J. R., &Naylor, J. C.. , ( 1990) . Judgment and decision-making theory. In D. M. Dunnette, & L. M. Hough (Eds.) Handbook of industrial and organizational psychology (pp. 283-374) . CA, US: Consulting Psychologists Press. |

| [60] | Su Y., Rao L. L., Sun H. Y., Du X. L., Li X., &Li S . ( 2013). Is making a risky choice based on a weighting and adding process? An eye-tracking investigation. Journal of Experimental Psychology: Learning, Memory, and Cognition, 39( 6), 1765-1780. doi: 10.1037/a0032861 doi: 10.1037/a0032861URLpmid: 23687917 |

| [61] | Vehtari A., Gelman A., &Gabry J . ( 2015). Efficient implementation of leave-one-out cross-validation and WAIC for evaluating fitted Bayesian models. ArXiv Preprint ArXiv:1507.04544. doi: 1007/s11222-016-9696-4 |

| [62] | Vincent B.T . ( 2016). Hierarchical Bayesian estimation and hypothesis testing for delay discounting tasks. Behavior Research Methods, 48, 1608-1620. doi: 10.3758/s13428-015- 0672-2 doi: 10.3758/s13428-015-0672-2URLpmid: 26542975 |

| [63] | Wagenmakers E-J., Love J., Marsman M., Jamil T., Ly A., Verhagen J., … van Doorn J . ( 2018 a). Bayesian inference for psychology. Part II?: Example applications with JASP. Psychonomic Bulletin & Review, 25( 1), 58-76. doi: 10.3758/s13423-017-1323-7 doi: 10.3758/s13423-017-1323-7URLpmid: 28685272 |

| [64] | Wagenmakers E.- J., Marsman M., Jamil T., Ly A., Verhagen J., Love J., … Morey R. D . ( 2018 b). Bayesian inference for psychology. Part I: Theoretical advantages and practical ramifications. Psychonomic Bulletin & Review, 25( 1), 35-57. doi: 10.3758/s13423-017-1343-3 doi: 10.3758/s13423-017-1343-3URL |

| [65] | Wang Z-J., &Li S . ( 2012). Tests of the integrative model and priority heuristic model from the point of view of choice process: Evidence from an eye-tracking study. Acta Psychologica Sinica, 44( 2), 179-198. doi: 10.3724/SP.J.1041.2012.00179 |

| [ 汪祚军, 李纾 . ( 2012). 对整合模型和占优启发式模型的检验:基于信息加工过程的眼动研究证据. 心理学报, 44( 2), 179-198.] doi: 10.3724/SP.J.1041.2012.00179URL | |

| [66] | Weber B.J., &Chapman G.B . ( 2005). The combined effects of risk and time on choice: Does uncertainty eliminate the immediacy effect? Does delay eliminate the certainty effect? Organizational Behavior and Human Decision Processes, 96( 2), 104-118. doi: 10.1016/j.obhdp.2005.01.001 doi: 10.1016/j.obhdp.2005.01.001URL |

| [67] | Weber B.J., &Huettel S.A . ( 2008). The neural substrates of probabilistic and intertemporal decision making. Brain Research, 1234, 104-115. doi: 10.1016/j.brainres.2008.07.105 doi: 10.1016/j.brainres.2008.07.105URLpmid: 2629583 |

| [68] | Wei Z-H., &Li X.S . ( 2015). Decision process tracing: Evidence from eye-movement data. Advances in Psychological Science, 23( 12), 2029-2041. doi: 10.3724/SP.J.1042.2015.02029 |

| [ 魏子晗, 李兴珊 . ( 2015). 决策过程的追踪: 基于眼动的证据. 心理科学进展, 23( 12), 2029-2041.] doi: 10.3724/SP.J.1042.2015.02029URL | |

| [69] | Wu F., Gu Q., Shi Z-H., Gao Z-F., &Shen M-W . ( 2018). Striding over the “classical statistical inference trap” —Application of Bayes factors in psychological studies. Chinese Journal of Applied Psychology, 24(3), 195-202. |

| [ 吴凡, 顾全, 施壮华, 高在峰, 沈模卫 . ( 2018). 跳出传统假设检验方法的陷阱——贝叶斯因子在心理学研究领域的应用. 应用心理学, 24(3), 195-202.] doi: 10.3969/j.issn.1006-6020.2018.03.001URL | |

| [70] | Wu Y., Zhou X-L., &Luo Y-J . ( 2010). The neuroscience of intertemporal choices and decision-making under risk and uncertainty. Studies of Psychology and Behavior, 84( 1), 76-80. |

| [ 吴燕, 周晓林, 罗跃嘉 . ( 2010). 跨期选择和风险决策的认知神经机制. 心理与行为研究, 8( 1), 76-80.] | |

| [71] | Zhang Y-Y., Xu L-J., Rao L-L., Zhou L., Zhou, Y, Jiang, T-Z, Li, S., &Liang Z-Y . ( 2016). Gain-loss asymmetry in neural correlates of temporal discounting: An approach-avoidance motivation perspective. Scientific Reports, 6, 31902. doi: 10.1038/srep31902 doi: 10.1038/srep31902URLpmid: 4997255 |

| [72] | Zhou L . ( 2017). Process comparison of risky choice and intertemporal choice: Evidence from eye-tracking method (Unpublished Doctoral dissertation). University of Chinese Academy of Sciences, Beijing, China. |

| [ 周蕾 ( 2017). 风险决策与跨期决策的过程比较:基于眼动研究的证据 (博士学位论文). 中国科学院大学.] | |

| [73] | Zhou L., Zhang Y-Y., Li S., &Liang, Z-Y .( 2018). New paradigms for the old question: Challenge the expectation rule held by risky decision-making theories. Journal of Pacific Rim Psychology, 12, e17. doi: 10.1017/prp.2018.4 |

| [74] | Zhou L., Zhang Y-Y., Wang Z-J., Rao L-L., Wang W., Li S., Li X. S., &Liang Z-Y . ( 2016). A scanpath analysis of the risky decision-making process. Journal of Behavioral Decision Making. 29( 2-3), 169-182. doi: 10.1002/bdm.1943 doi: 10.1002/bdm.1943URL |

相关文章 15

| [1] | 宋锡妍, 程亚华, 谢周秀甜, 龚楠焰, 刘雷. 愤怒情绪对延迟折扣的影响:确定感和控制感的中介作用[J]. 心理学报, 2021, 53(5): 456-468. |

| [2] | 张银玲, 虞祯, 买晓琴. 社会价值取向对自我-他人风险决策的影响及其机制[J]. 心理学报, 2020, 52(7): 895-908. |

| [3] | 王盼盼, 何嘉梅. 情景预见对跨期决策的影响机制[J]. 心理学报, 2020, 52(1): 38-54. |

| [4] | 杨玲,王斌强,耿银凤,姚东伟,曹华,张建勋,许琼英. 虚拟和真实金钱奖赏幅度对海洛因戒断者风险决策的影响[J]. 心理学报, 2019, 51(4): 507-516. |

| [5] | 王鹏, 王晓田, 高娟, 黎夏岚, 徐静. 适应性时间管理:死亡意识对时间知觉和跨期决策的影响[J]. 心理学报, 2019, 51(12): 1341-1350. |

| [6] | 徐岚, 陈全, 崔楠, 陆凯丽. 享受当下, 还是留待未来?——时间观对跨期决策的影响[J]. 心理学报, 2019, 51(1): 96-105. |

| [7] | 李爱梅, 王海侠, 孙海龙, 熊冠星, 杨韶丽. “长计远虑”的助推效应:怀孕与环境跨期决策 *[J]. 心理学报, 2018, 50(8): 858-867. |

| [8] | 陈嘉欣;何贵兵. “金钱−环境”复合收益的风险决策:价值取向的影响[J]. 心理学报, 2017, 49(4): 500-512. |

| [9] | 刘扬;孙彦. 时间分解效应及其对跨期决策的影响[J]. 心理学报, 2016, 48(4): 362-370. |

| [10] | 刘洪志;江程铭;饶俪琳;李纾. “时间折扣”还是“单维占优”? ——跨期决策的心理机制[J]. 心理学报, 2015, 47(4): 522-532. |

| [11] | 李爱梅;彭元;熊冠星. 孕妇更长计远虑?——怀孕对女性跨期决策偏好的影响[J]. 心理学报, 2015, 47(11): 1360-1370. |

| [12] | 陆青云;陶芳标;侯方丽;孙莹. 青少年应激下皮质醇应答与风险决策相关性的性别差异[J]. 心理学报, 2014, 46(5): 647-655. |

| [13] | 荆伟;方俊明;赵微. 自闭症谱系障碍儿童在多重线索下习得词语的眼动研究[J]. 心理学报, 2014, 46(3): 385-395. |

| [14] | 徐四华;方卓;饶恒毅. 真实和虚拟金钱奖赏影响风险决策行为[J]. 心理学报, 2013, 45(8): 874-886. |

| [15] | 徐四华. 网络成瘾者的行为冲动性—— 来自爱荷华赌博任务的证据[J]. 心理学报, 2012, 44(11): 1523-1534. |

PDF全文下载地址:

http://journal.psych.ac.cn/xlxb/CN/article/downloadArticleFile.do?attachType=PDF&id=4406